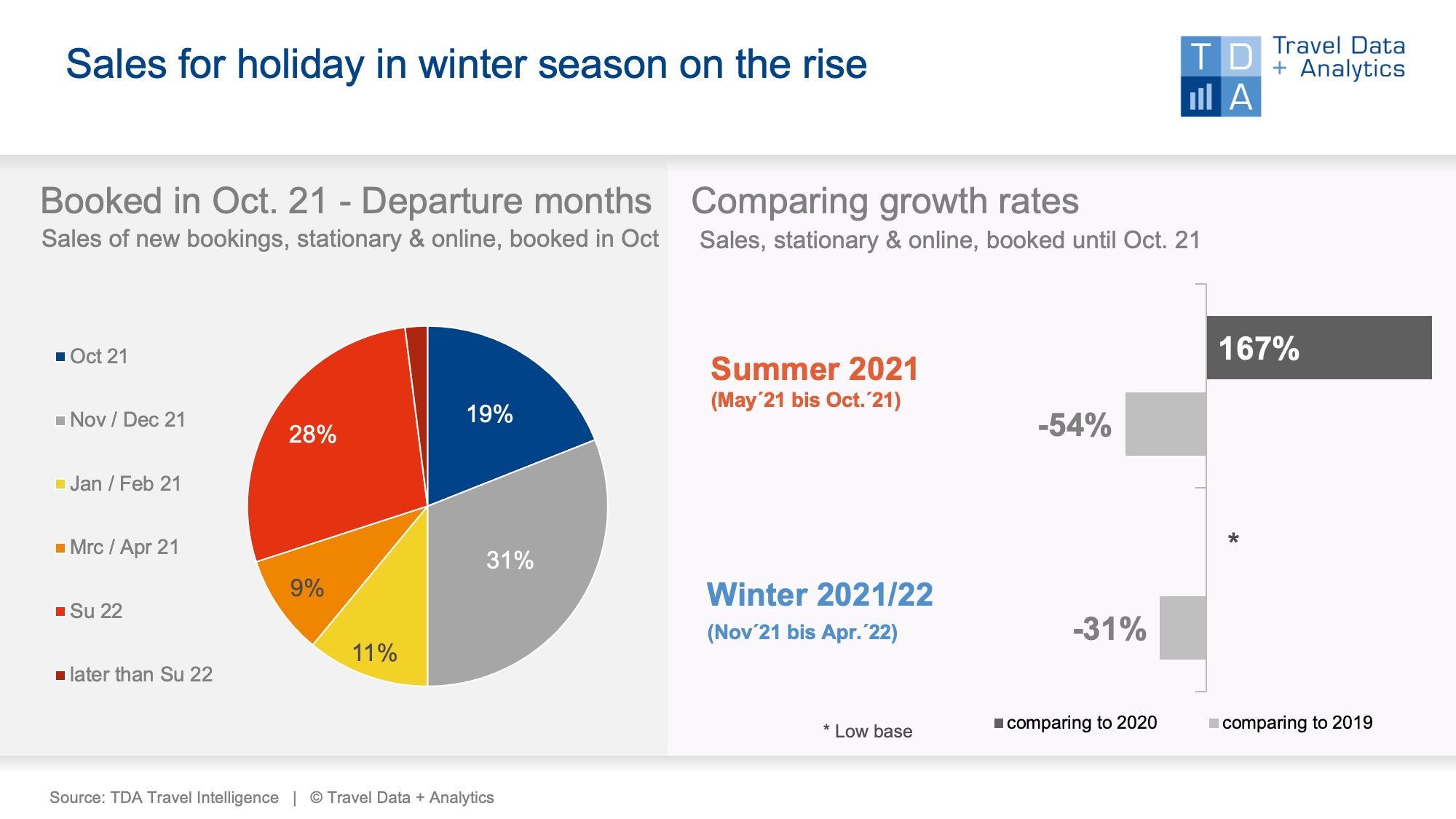

Nuremberg, 30 November 2021 - As of the booking status at the end of October 2021, the 2021 summer season and the 2020/21 tourist year have been completed. The final balances: This year's summer season achieves in sales less than half of what was realised in the pre-Corona summer of 2019 in terms of holiday trips (-54 per cent). In contrast, the previous year's summer 2020 is significantly exceeded (+167 per cent). The 2020/21 tourism year shows - almost identical to the previous year - a cumulative loss in sales of 68 per cent. The past winter season, which was marked by the second lockdown and massive travel restrictions, is reflected here. The new winter season 2021/22, on the other hand, has picked up speed with the booking volume in October.

The demand situation for holiday travel in the booking month of October 2021 is still at a good level of sales that is almost comparable with 2019. Just under one-fifth of the monthly turnover was accounted for by "last minute" holidays booked with departure in October. The 2021 summer season can thus improve on the previous month by another two percentage points. Since May, the cumulative turnover losses have continued to decrease from month to month. However, with a final figure of minus 54 percent compared to summer 2019, the summer holiday travel business in 2021 still remains far below the level of what is normally travelled. Compared to the previous year's season 2020, this year's summer sales are much higher: An increase of 167 per cent corresponds to almost 3.5 billion more turnover with tour operator holidays organised on a package or modular basis. However, the significant year-on-year improvement in summer business cannot compensate for the losses incurred in the past winter season 2020/21 (-94 per cent): The tourism year running from November 2020 to October 2021 thus ends slightly better than the previous year (+3.5 per cent), but ultimately with equally high losses compared to the pre-Corona level (-68 per cent).

The new 2021/22 winter season continued to gain momentum with the booking volume in October: Around half of the month's turnover was owed to winter holiday bookings, most of it for the early travel months of November/December. In particular, long-haul destinations such as the USA and Thailand saw strong growth compared to the previous month. The Dominican Republic, Maldives and United Arab Emirates also remained in high demand on long-haul routes.

Cumulatively, the new winter season currently stands at minus 31 per cent compared to the 2019/20 winter season - last month it was minus 43 per cent. What favours the striking improvement: These adjusted statistics no longer include winter holidays in March and April 2020 that were booked until October 2019 but later cancelled due to the Corona pandemic.

It is foreseeable that the currently strongly rising Corona numbers will again reduce the demand for winter holidays. In the first two weeks of November, a slight downward trend in new bookings is already discernible. In addition, some travel countries have now classified Germany as a risk area. Although the entry restrictions still mainly affect the unvaccinated, it is uncertain how things will look in a few weeks with the exponential increase in covid cases. The travel industry may be in for another difficult winter.

Legend:

The chart shows the cumulative travel revenue generated by the end of October 2021 for the 2021 summer season and the 2021/22 winter season in comparison with the previous year and the previous year. For the winter season, TDA compares the booking status adjusted for trips cancelled in March and April 2020 due to Corona. Both holiday travel bookings in stationary travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month of September accounted for by the individual travel months and seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03