Nuremberg, June 24th, 2021 - With increasing freedom of travel, the number of holiday bookings for tour operator trips organized in packages or in modules is currently increasing significantly in travel sales (stationary and online). Since mid-May (20th calendar week), new booking sales have already exceeded the pre-Corona level in 2019 - by a remarkable 48 percent in mid-June in week 23. The booking month of May as a whole shows “only” a comparatively moderate deficit of 18 percent compared to May 2019. Compared to April, booking sales increased almost fivefold in May.

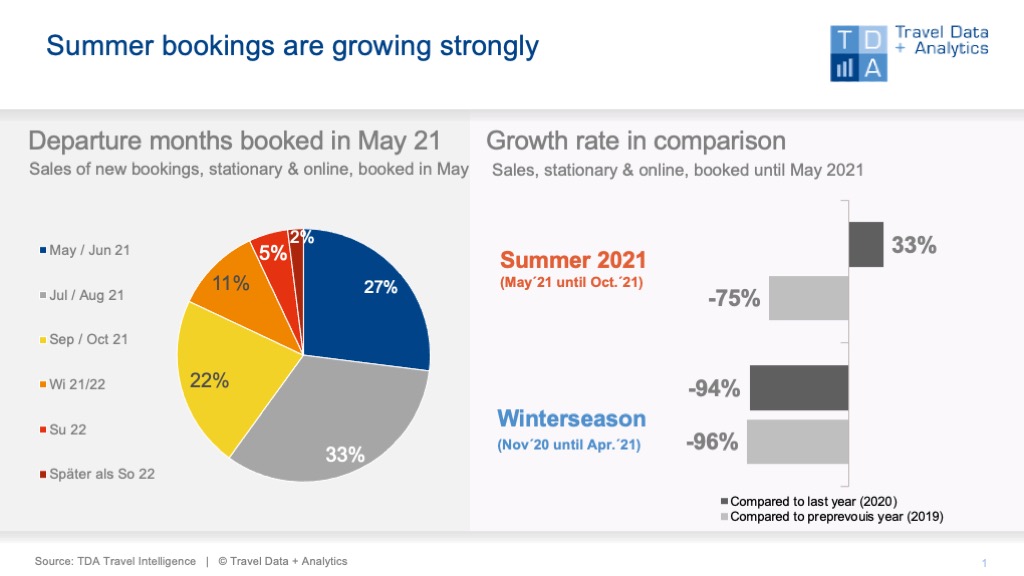

Despite the upturn in bookings, which has been observed for a few weeks, the losses so far during the lockdown, especially in the normally busy first months of the year, are far from being balanced in the balance sheet. Cumulatively, i.e. booked up to and including the end of May 2021, the current summer season 2021 is still down by 75 percent compared to the pre-Corona summer 2019. However, the previous summer of 2020 has already been exceeded in terms of the current booking status (+33 percent).

As more and more holiday destinations are opening up to tourists from Germany, the number of short-term travel bookings is currently increasing. In May accounted for 27 percent of the Booking turnover in sales on last-minute departures in May or June and a further 33 percent on the main travel season in July and August 2021. In the first two weeks of June, holiday bookings for the holiday season even accounted for up to half of the new booking turnover. While the previous booking months were characterized by a largely cautious early bird behavior, the trend is now reversing. "The desire to finally be able to travel again is obviously great and travel relief and increasing vaccination rates are spurring the vacation business", says Alexandra Weigand, Director Sales & Consulting at Travel Data + Analytics.

Among the travel bookings received so far for this year's summer vacation, Spain has now replaced Greece as the most booked holiday destination and combines a sales share of 29.1 percent of all booking sales generated so far for tour operator trips (excluding cruises). Greece has a share of almost a quarter (24.5 percent). If Spain is separated into the target areas of the Balearic Islands, Canary Islands and the Spanish mainland, Mallorca in particular shows particularly strong growth - with an increase of 60 percent compared to the previous summer. The Canary Islands have already clearly exceeded their previous year's level. For Turkey (currently in third place, share of sales 12.8 percent), the holiday demand is already increasing visibly again in May, although the status as a high-incidence area was not lifted until June.

Legend:

The chart shows the cumulative travel revenues generated until the end of May 2021 for the summer season 2021 in comparison with the previous year (May 2020) and the year before (May 2019). Both holiday travel bookings in stationary travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of turnover in the booking month of March accounted for by the individual travel months and seasons.

Note: Since the booking month of March 2021, Travel Data + Analytics has also used 2019 as a pre-Corona comparison, as bookings collapsed from mid-February 2020 and hardly any travel took place in the first lockdown.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03