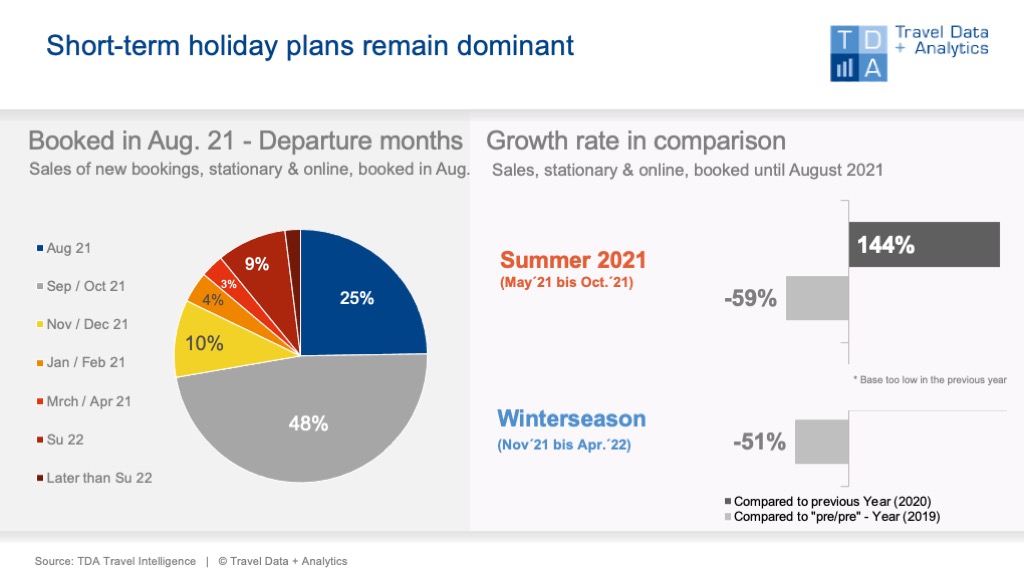

Nuremberg, September 30, 2021 – By the end of August 2021, the cumulative decline in sales for this year's summer season compared to the pre-Corona summer of 2019 has further decreased - by three percentage points to a minus of 59 percent compared to the previous month. Germans continue to book an exceptionally high proportion of their holidays at very short notice. The fact that they are "travelling on sight" has a negative impact for the upcoming 2021/22 winter season, which has a cumulative shortfall of 51 per cent compared to the largely intact 2019/20 winter season.

Since May 2020, when holiday bookings visibly picked up again with less restrictions for traveling, the summer balance has improved from month to month - from minus 75 per cent then to minus 59 per cent currently. Even if the gap to pre-crisis levels is expected to shrink somewhat further in the remaining two booking months of the season, travel distribution will have to cope with another travel season with high losses. Nevertheless: The particularly loss-making summer season of 2020 will be clearly surpassed this year. A current increase of 144 per cent corresponds to almost 2.8 billion euros more turnover with tour operator holidays organised on a package or modular basis this summer.

Travel decisions continue to be made predominantly at short notice: A quarter of the booking turnover in August was also departed in the same month. Another 48 per cent were for holidays in September and for the autumn holidays in October. The focus was on the Canary Islands and Greece as well as Turkey and the Balearic Islands.

Advance bookings for the upcoming winter season2021/22 are still below average with a turnover share of 17 per cent. Holidaymakers lack planning certainty and some of the popular long-haul destinations, especially in the winter half-year, were hardly bookable in August due to existing travel restrictions. As a result, the 2021/22 winter season cumulatively shows 51 percent less turnover than the 2019/20 winter season at the current booking level. The losses have increased by two percentage points compared to the previous month. However, it is foreseeable that the tide could soon turn: The USA, for example, will allow foreign tourists back into the country just in time for the winter season. And more and more destinations are loosening their restrictions, especially for those who have been vaccinated.

According to current bookings, the Canary Islands are by far the most popular winter destination. The Maldives (rank 2) as well as the Dominican Republic (rank 4) have almost reached pre-Corona level.

Legend:

The chart shows the cumulative travel revenues generated by the end of August 2021 for the 2021 summer season and the coming 2021/22 winter season in comparison with the previous year and the previous year. (A comparison with the previous year is not meaningful for the winter season, as almost all winter trips were ultimately cancelled between November 2020 and April 2021). Both holiday travel bookings in stationary travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of turnover in the booking month of August accounted for by the individual travel months or seasons.

Note: Since the booking month of March 2021, Travel Data + Analytics has also used 2019 as a pre-Corona comparison, as bookings collapsed from mid-February 2020 and hardly any travel took place during the lockdowns.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03