Nuremberg, December 30, 2024 – In the booking month of November 2024, German citizens booked holiday trips organised as packages or building blocks for almost EUR 2 billion. This is an increase of 9% compared to November 2023. Online sales grew particularly strongly in November, with the Black Week obviously having generated an above-average amount of money. For the tourism year 24/25 as a whole, the current level of bookings sends a clear signal: despite all the crisis reports and visible challenges, Germans are not letting the desire to travel be spoilt.

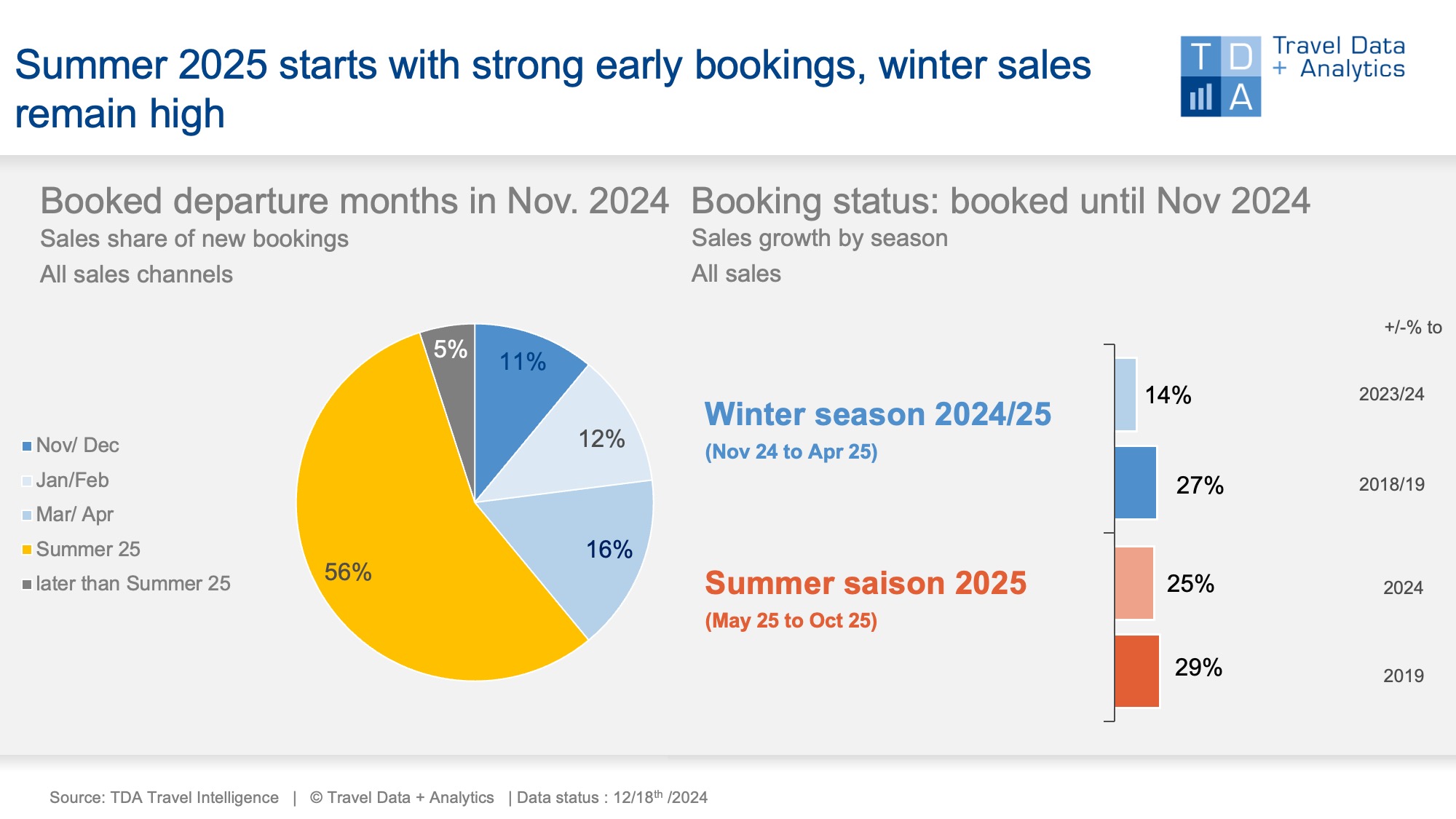

Holiday bookings for the tourism year 24/25, which has now started, are already up 18% per cent, showing a robust early booking phase for summer 2025 as well as significant interest in the upcoming winter season. Demand is particularly strong for Spain, Turkey, Egypt and Greece. Cumulatively, these four destinations account for 60% of bookings up to November. 56% of bookings were made in November for summer 2025 (May to September). However, the development in the winter season also deserves special attention this year, as Egypt is being marketed for the first time without the long-standing top dog FTI and the armed unrest in the immediate neighbourhood is still dominating reporting on the region.

At the end of November, 72% of sales for the winter season had already been booked compared to the end of the previous year, an increase of 14% compared to winter 23/24. A good quarter of sales are attributable to the blockbuster of the winter season: Spain with the Canary Islands. Egypt follows in second place, followed by Turkey. All three holiday destinations recorded above-average growth in sales, with Turkey clearly leading the way with an increase of 37%. Egypt follows in the growth ranking. The efforts of the Egyptian tourism authority to defy the impact on demand caused by the FTI bankruptcy and difficult media reports appear to be working. It is particularly striking: Egypt even managed to increase by 30% compared to the previous year in the family target group.

TDA observed an exceptional increase in bookings of around € 100 million during Black Week, this year calendar week 48. This means that weekly sales during Black Week exceeded the usual sales of an average November week by 20%. A similar booking pattern was also seen in 2023, back then in calendar week 47 as Black Week. It seems worthwhile to increase marketing efforts during Black Week or similar promotional periods aimed at early bookers. Ultimately, once these bookings have been made, they are no longer part of the marketable potential, as holiday time, once booked, is simply blocked for other travel offers. In line with the upcoming ski season, it is important to take as much momentum as possible from the start of the early booking phase. Nobody wants to have to realise later on in the flattening booking process that performance is not sufficient to make fast enough progress in the flat section.

Legend:

The chart shows the cumulative holiday bookings generated by the end of November 2024 for the current winter season 2024/2025 and the upcoming summer season 2025 compared to the previous year and the pre-corona level (summer 2019, winter 2018/19). TDA's analyses include holiday travel bookings in brick-and-mortar travel agencies as well as online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package holidays. The chart on the left shows the percentage of sales in the booking month of November accounted for by the individual travel months and seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03