Nuremberg, January 31, 2023 – In December 2022, on the German Tour operator market the bookings for holiday trips have been performed very well. Especially in the last week of December and the first week of January, sales volume in leisure trips not only exceeded the previous year's level, but also the comparable weeks of 2019 by far. Cumulatively, the seasonal balances at the end of December can thus improve significantly compared to the previous month: The coming summer season 2023 shows a sales growth of 44 percent compared to the previous year, the backlog to summer 2019 continues to melt. The 2022/23 winter season has now reached 85 percent of its pre-corona level.

December 2022 was an exceptionally strong booking month, in which travel agencies and online travel portals achieved almost as high revenues from holiday bookings as in the previous month. This is an atypical process, as the booking curve usually weakens over the pre-Christmas period and holidays before peaking in January. Currently, holiday demand is comparable in terms of sales volume to the pre-corona level. In the first week of January, Germans booked holiday trips with German tour operators for almost 700 million euros – around a third more than in the first week of January 2019.

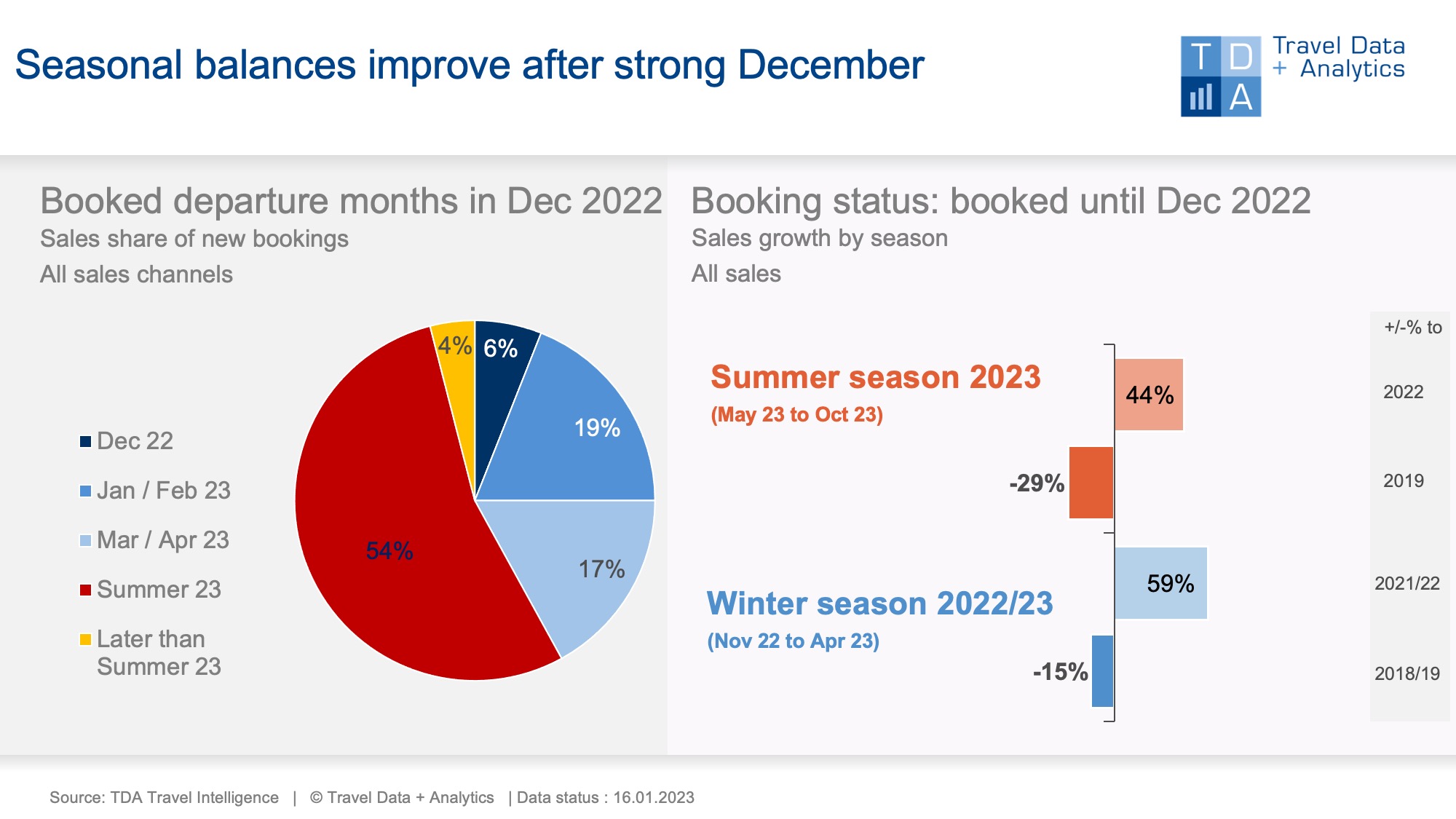

With the good level of booking intake in December, both the current winter season 2022/23 and the coming summer season 2023 can improve significantly: The sales balance of the winter season climbed by four percentage points compared to the previous month to a gap of 15 percent to the pre-corona level 2018/19. The previous year's season, which was still comparatively weak due to corona, is currently exceeded in sales by 59 percent.

The coming summer season, which begins with the travel month of May 2023, can even improve by 17 percentage points to an increase of 44 percent compared to the previous year compared to the booking status at the end of December 2022. Unlike last year, the early bird is returning noticeably. In the summer of 2019, however, there is still a gap: 29 percent of sales are missing, 6 percentage points less than in the previous month.

Summer holidays account for 54 percent of booking revenue in December 2022 and rise to 61 percent of new bookings in the first week of January. Turkey is in high demand for the coming summer holiday – ahead of Spain and followed by Greece in 3rd place. In terms of travel regions or segments, the holiday countries in the Eastern Mediterranean account for around 42 percent of the summer sales achieved so far – an increase of 68 percent compared to the previous year and a below-average minus of 10 percent compared to summer 2019. The greatest growth compared to the previous year was recorded in long-haul travel (+75 percent), which only recovered in the course of the past year after corona-related entry regulations and requirements were lifted.

Legend:

The chart shows the cumulative travel sales generated up to the end of December 2022 for the ongoing 2022/23 winter season and the coming summer season 2023 in comparison to previous years (summer season 2019 and winter season 2018/19). For the travel seasons, TDA compares the booking status adjusted for trips that were cancelled in previous years due to corona. Both holiday travel bookings in high street travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month October that belongs to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03