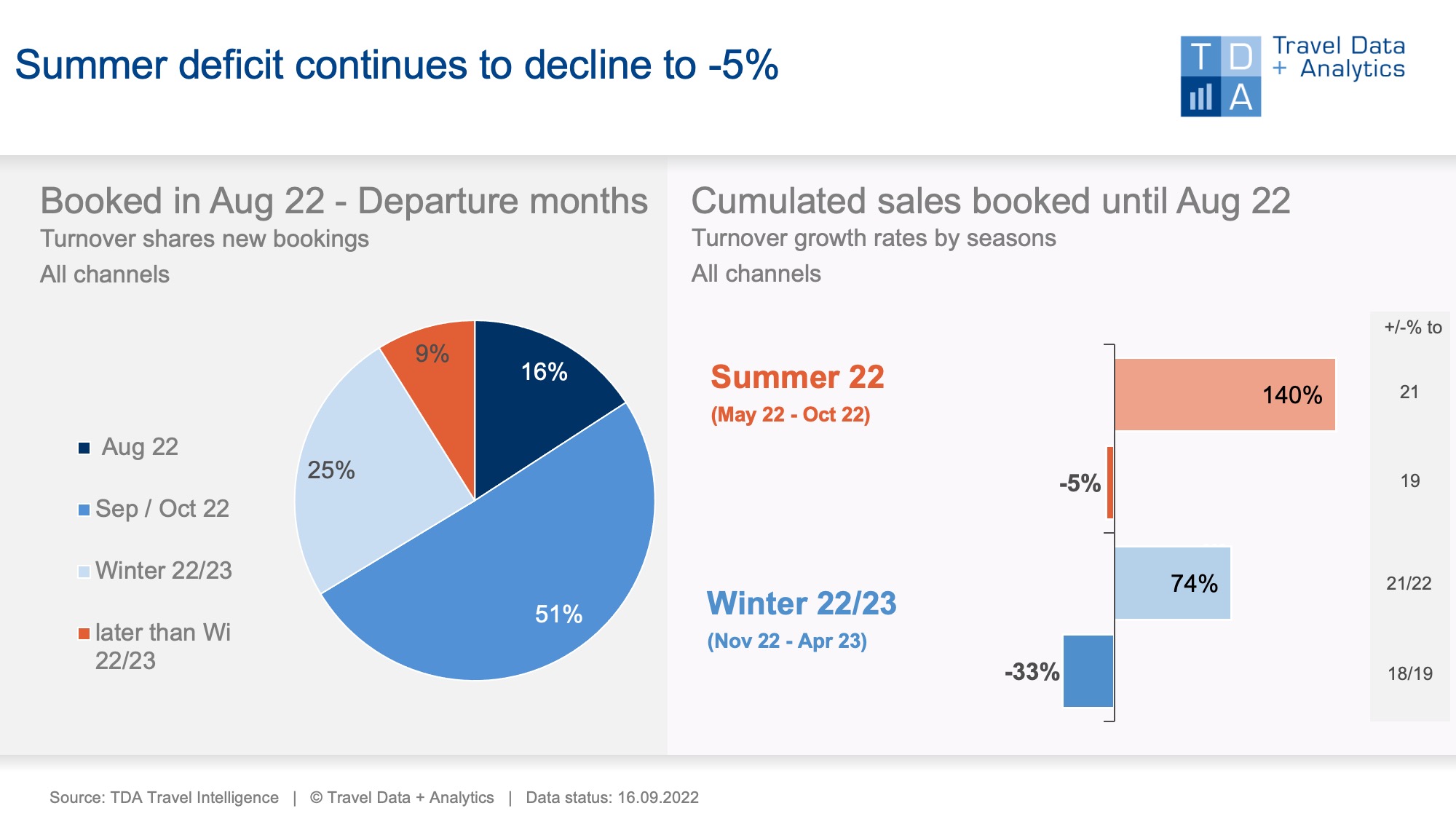

Nuremberg, September 30th, 2022 – In the booking month of August 2022, holiday demand in the German market continues to be unimpressed by massively rising costs for energy and food, at least for travel in the current summer season. Revenues generated in travel sales showed an increase of 11 percent in both the previous month of July and August 2019 as a comparable month at pre-Corona level. This means that the backlog of the summer seasons of 2022 compared to 2019 will melt by two percentage points to a decline in sales of 5 percent. The coming winter season may also improve slightly by two percentage points compared to the booking level at the end of August (current status: -33 percent).

After a booking month with a stagnating balance sheet, the current summer season picked up speed again in August: 16 percent of the monthly turnover is accounted for by "last minute" booked holiday trips with departure in August. Autumn holidays in September and October, which account for a good half of the monthly turnover in travel sales, are even more in the focus of German citizens. The booking behaviour of holidaymakers keeps more short-term than it has been in times “free of crisis”. In August 2022, no holiday destination was in greater demand for tour operators than Spain with the Balearic Islands and the Canary Islands (24 percent). This is followed by Turkey (revenue share: 19 percent) and Greece also remains in demand for autumn trips (revenue share: 12 percent).

The overall shorter-term planning horizon for holiday trips is at the expense of the upcoming winter season 2022/23, which begins with the travel month of November. Winter holidays account for a quarter of the travel revenues booked in travel agencies and on the travel portals of tour operators and OTAs in August 2022. Although this is a decent increase of 7 percentage points compared to the previous month, it is only below average compared to the pre-Corona level: In August 2019, the share of sales for winter travel was 33 percent, i.e. 8 percentage points higher.

Long-distance travel is an important factor in the winter business. In August, they account for 14 percent of monthly sales and show growth of 17 percent compared to the previous month. This speaks for an increasing demand. Cumulatively, however, long-distance travel is still 37 percent behind the current booking level and compared to the winter half of 2018/19. Compared to the previous month, Thailand (+50 percent) and Mexico (+48 percent) in particular posted strong growth.

Legend:

The chart shows the cumulative travel sales generated up to the end of August 2022 for the 2022 summer season and the coming 2022/23 winter season in comparison to previous years (2019 and 2021 summer and 2018/19 and 2020/21 winter seasons). For the travel seasons, TDA compares the booking status adjusted for trips that were cancelled in previous years due to corona. Both holiday travel bookings in high street travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month March that is attributable to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03