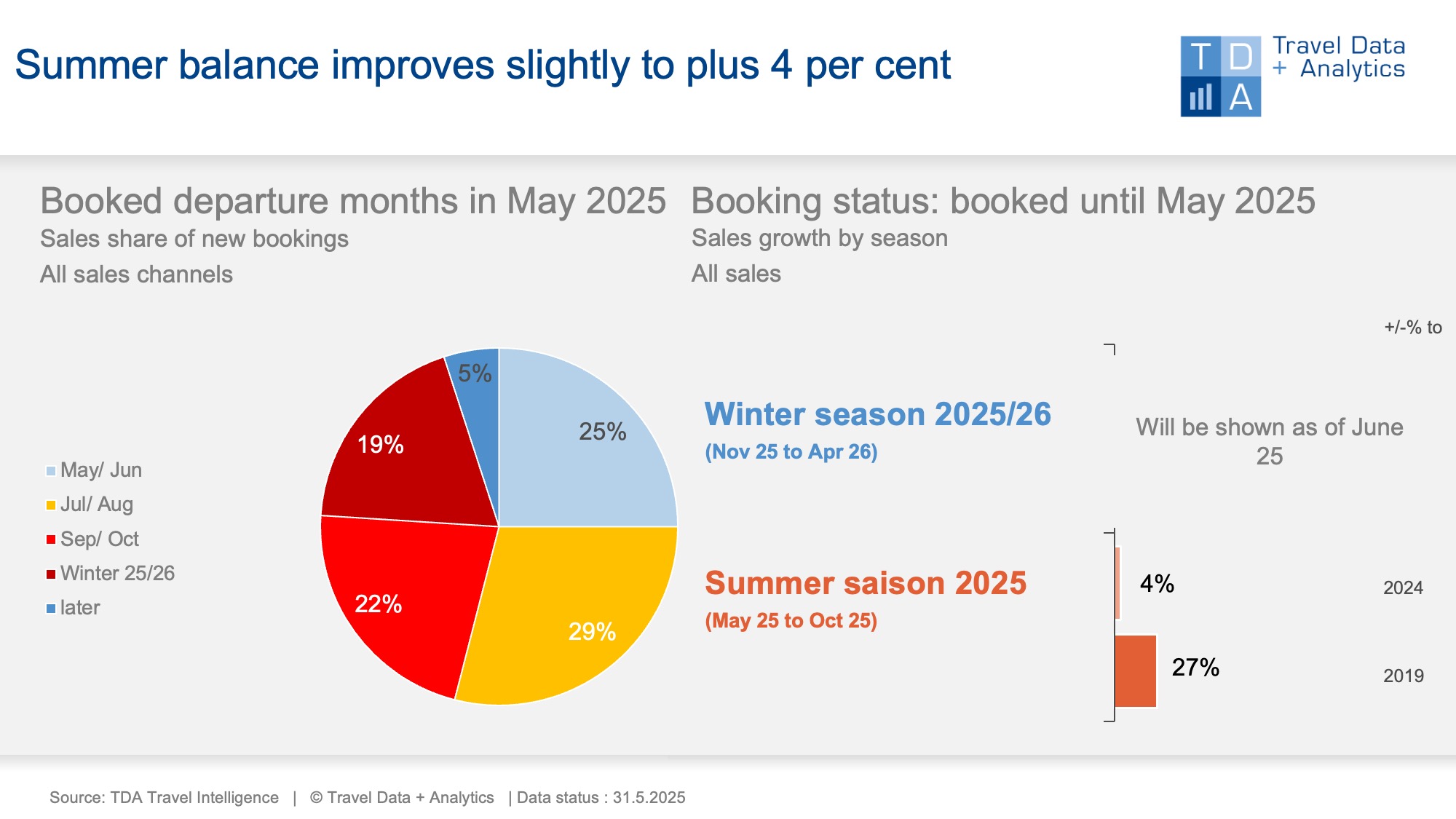

Nuremberg, June 30, 2025 – This year's booking month of May ends with an 8 percent increase in sales compared to the same month last year. This is enough to slightly improve the cumulative summer balance again: it is up one percentage point on the previous month to plus 4 per cent. This means that - measured in terms of total sales for last year's 2024 summer season - the current booking level is now 77 per cent full. Short-term holiday bookings pick up speed in May: Whitsun holidays accounted for almost a fifth of the month's bookings.

Short-term and early bookers almost balanced each other out in the booking month of May: in terms of turnover, 25 per cent booked short-term holidays for May and more over the Whitsun holidays in June, while 24 per cent had already secured their winter or summer holidays for the coming year. Travel bookings for the peak summer travel period in July and August are now visibly increasing: to 29 per cent in May (previous month: 24 per cent) and already to 37 per cent by mid-June (week 24). "Tour operators have started the last-minute season with high discounts to boost demand. There is clearly still plenty of summer capacity available on the market, as the growth to date is due to higher prices, not increased demand," explains Alexandra Weigand, Director Sales & Consulting at Travel Data + Analytics.

Long-distance travel currently accounts for just under 10 percent of sales in the summer half-year and, like cruises, is growing at 6 percent above the market average, although the decline in the strong summer destination USA is increasingly making itself felt in the organised holiday travel market. Thanks to very good advance bookings, the US remains in the top 10: By the end of January, up to 73 per cent of sales for the travel months in this year's summer had already been booked. The decline in demand that began in February has now turned the cumulative figures into negative territory: In terms of sales, the USA is already down 18 per cent year-on-year for the current 2025 summer season, and 24 per cent in terms of booked holidaymakers. The losses can be offset by high-growth long-haul destinations such as the Maldives, Mauritius, Thailand and the Dominican Republic, but without the weakness of the USA, long-haul growth would be higher.

Whether and to what extent the current war between Israel and Iran and the associated travel advice issued by the German Foreign Office for the entire Middle East will have an impact on the holiday travel business will not be assessable until the coming booking month of June at the earliest. This is also when holiday bookings will start to pick up following the FTI insolvency last year and TDA will publish its first booking figures for the coming 2025/26 winter season.

Legend:

The chart shows the cumulative holiday bookings generated by the end of May 2025 for the next winter season 2025/2026 and the current summer season 2025 compared to the previous year. TDA's analyses include holiday travel bookings in brick-and-mortar travel agencies as well as online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package holidays. The chart on the left shows the percentage of sales in the booking month of May accounted for by the individual travel months and seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03