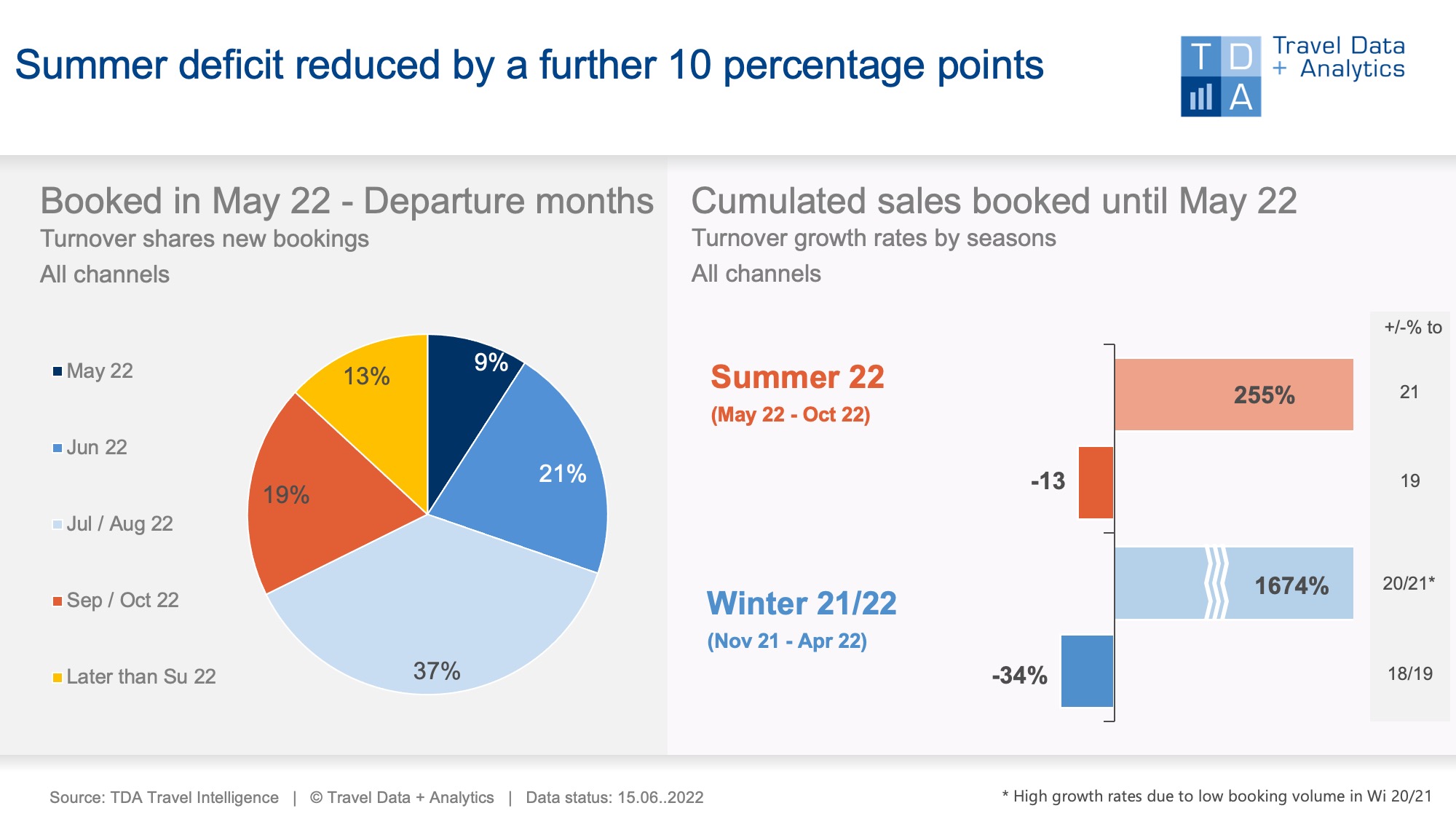

Nuremberg, June 30, 2022 – In May 2022, holiday travel bookings in sales exceeded both the previous month (+ 13 percent) and May 2019 as a benchmark to the pre-Corona level: the latter by a remarkable 51 percent. The catch-up race of the low-booking winter months is still ongoing: Cumulatively, the backlog of the summer season 2022 to the previous month melts by a further 10 percentage points to a minus of currently 13 percent to the booking level at the end of May. As the positive booking trend has continued in June, so far, it is to see: Current summer season will have achieved the turnaround in two months.

With the continuing extremely good holiday demand in the German market, it can no longer be ruled out that the 2022 summer season will return to growth as the first travel season since the outbreak of the corona pandemic – provided that the airlines' many flight cancellations due to staff shortages do not thwart the Germans' holiday desire. Whether and to what extent this effect will have an impact will only become clear with the June data.

In May 2022, Germans booked holiday trips for around 1.8 billion euros in travel agencies and on the travel portals of tour operators and classic online travel agencies (OTAs). Almost a third of this is accounted for by short-term departures in May and June, a further 37 percent by the school holidays in July and August. Based on the summer season 2022 with the travel months from May to October, the booking intake in May exceeds the pre-corona month of May 2019 by a proud 71 percent.

Holiday trips to Turkey are in high demand. Compared to the previous month, bookings increased by 27 percent, and in May 2022 they accounted for 21 percent of booking revenues. After the long-distance travel destinations of the Dominican Republic and the Maldives, Turkey thus has the highest cumulative growth compared to the 2019 summer season (+22 percent) and has almost caught up with Greece (Greece cumulated: +14 percent). Egypt has also already exceeded the pre-corona level at the current level of bookings (+6 percent). Especially the Balearic Islands but also the Canary Islands and Portugal are approaching the black zero. Compared to the previous month, Bulgaria, Croatia and Tunisia also recorded strong growth, as well as Thailand on long-haul routes. Cumulatively, however, these holiday destinations for the current summer season are all still relatively far from their 2019 levels.

The sales volume generated to date is still too small for a reliable statement on the coming winter season 2022/23. However, it is striking that winter holidays are only booked below average in terms of turnover. In May 2022, they account for 13 percent of total sales, in May 2019 it was a good 24 percent. In their holiday planning, Germans continue to drive "on sight" – who knows when the next corona wave will destroy holiday plans again. Another influencing factor that cannot yet be estimated is high inflation, which will undoubtedly leave its mark on the holiday budgets of Germans.

Legend:

The chart shows the cumulative travel sales generated up to the end of May 2022 for the 2022 summer season and the 2021/22 winter season in comparison to previous years (2019 and 2021 summer and 2018/19 and 2020/21 winter seasons). For the travel seasons, TDA compares the booking status adjusted for trips that were canceled in previous years due to corona. Both holiday travel bookings in stationary travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month March that is attributable to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03