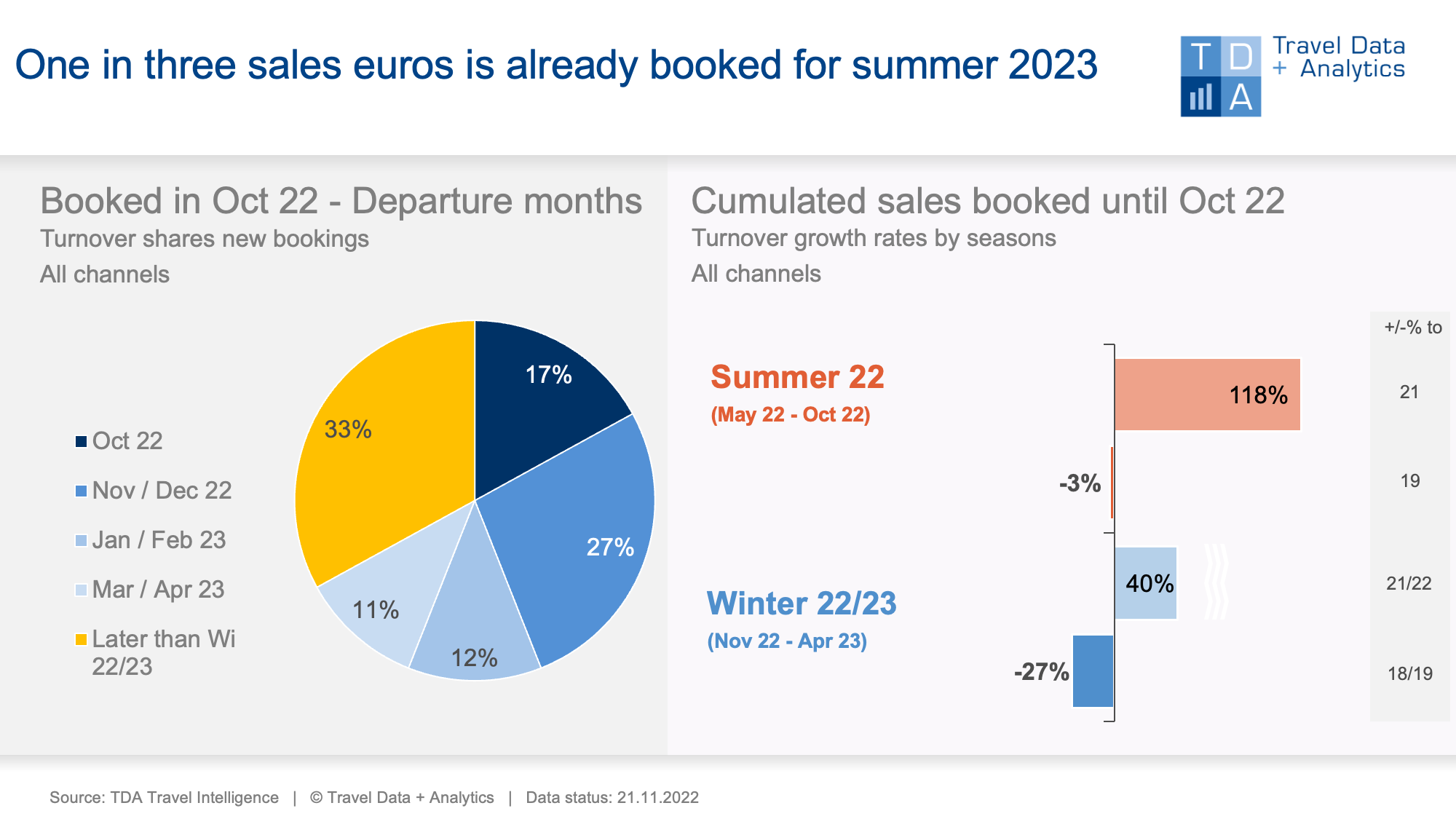

Nuremberg, November 30, 2022 - The booking level at the end of October 2022 and the 2022 summer season, both end with 3 percent less sales than in 2019, while the entire 2021/22 tourism year, including the past winter season, ends with a minus in the amount of 13 percent. However, the summer season just jailed to reach the pre-corona level from 2019. Regarding the tourism year, the Corona-related weak winter season of 2021/22 pressed down the result. The new winter season 2022/23 is improving slightly by 3 percentage points compared to the previous month, but still shows a cumulative lack of sales by 27 percent. Incoming sales for winter vacations remain below average.

During October, 17 percent of monthly sales counted clearly to last-minute vacation bookings with departure dates within the same months. Although the share of last-minute bookings remains unusually high, the overall level of sales in the last booking month of the season is too low to improve the summer closing balance. With a sales minus of 3 percent at the end of the season, this year's summer season just missed to reach the figures from the pre-Corona summer 2019. At the same time, however, it is the first travel season since the outbreak of the Corona pandemic in winter 2020 that does not have to close with high double-digit losses. In this respect, a comparatively small drop of 3 percent can certainly be considered a success.

By the end of October 2022, the 2021/2022 tourism year (Tour Operator definition) closes with a 13 percent loss of sales. This reflects the impact of the previous winter season 2021/2022, which was weak due to Corona and closed with a 34 percent drop in sales. Considered the year as a whole, the travel industry will be short almost 2.3 billion euros in vacation travel revenue.

The question is, if sales of the coming year will close this gap again? The winter season 2022/23 shows at this stage of booking entry a cumulative decline in sales of 27 percent. Compared to the previous month, the balance has thus improved by 3 percentage points, but incoming bookings in terms of revenue are not keeping pace with either the same month last year (-5 percent) or October 2019 as a comparative figure to the pre-Corona level (-14 percent). Measured in terms of people booked (pax), the shortfall is even higher: Only a half of Germans who like to travel in a packaged way have booked their winter vacation so far. Instead of Corona, it is now obviously more financial concerns in view of extremely rising prices, especially in the energy sector, that are leading to a wait-and-see booking behavior. Those, which booked their winter vacation in October, set on long-distance journeys (conversion portion with the organizer journeys without cruises: 19 per cent) and the classical winter travel destinations like Turkey and Canary islands (in each case 18 per cent) as well as Egypt (12 per cent). Cumulatively, however, only Turkey has so far succeeded in reaching or even exceeding the sales level of winter 2018/19 (+14 percent).

Moreover, in the booking month of October, one in three euros of sales in travel agencies and on the online travel portals of tour operators and OTAs is already spend for the summer season of the coming year. In terms of sales, incoming bookings for summer 2023 are up on the previous year (+9 percent) but well below what could be booked for summer 2019 at this time (-42 percent).

Legend:

The chart shows the cumulative travel sales generated up to the end of October 2022 for the 2022 summer season and the coming 2022/23 winter season in comparison to previous years (2019 and 2021 summer and 2018/19 and 2020/21 winter seasons). For the travel seasons, TDA compares the booking status adjusted for trips that were cancelled in previous years due to corona. Both holiday travel bookings in high street travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month October that belongs to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03