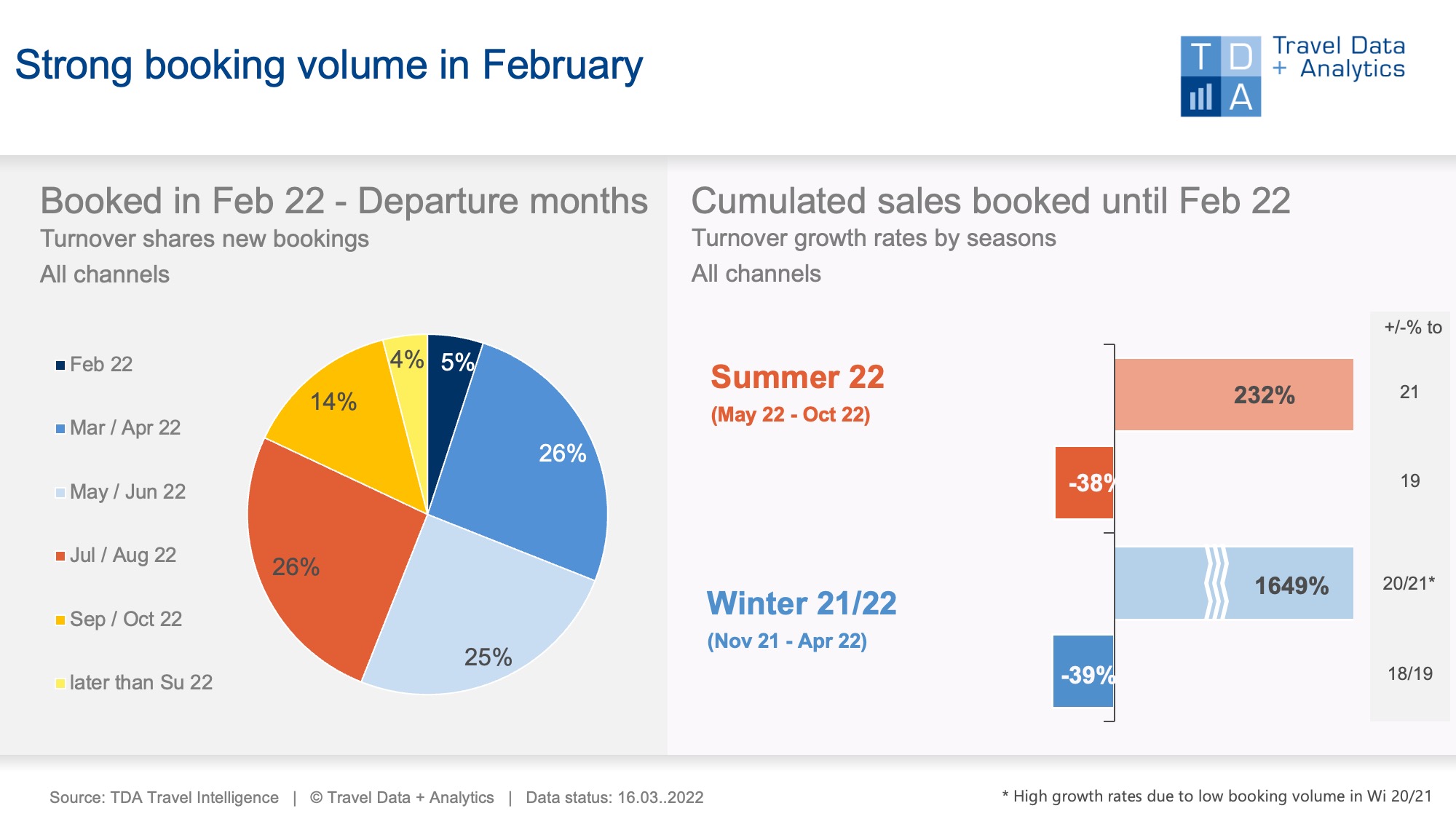

Nuremberg, 31 March 2022 - The from Pre-Corona times well known typical booking peak in January has shifted to February this year, reaching its peak in the middle of the month (week 7). In total, holiday travel for almost 1.9 billion euros was booked in travel agencies and online travel portals in February 2022 - 24 percent more than in January and 13 percent more than in February 2019 in comparison to Pre-Corona times. With the extraordinary high booking volume of February, the booking levels of the current winter - and coming summer season improve considerably: the deficit of the winter season 2021/22 is reduced by seven percentage points to a minus of now 39 percent, that of the summer season 2022 melts by ten percentage points to currently minus 38 percent.

Compared to the previous month, the booking volume for holidays in March and for Easter in April in particular rose sharply in February: A good quarter of the monthly turnover is accounted for by these two travel months, so that the winter season level is improving strongly two booking months before its end.

At a share of two thirds of the monthly turnover, the upcoming summer holiday 2022 dominates the interest of German citizens willing to travel. The current booking volume is highly concentrated: 75 percent of the turnover is accounted for by the holiday destinations around the Mediterranean Sea. Compared to the previous month, the western med - region in particular is gaining ground: Bookings for Spain in February were even higher than for Greece and Turkey together. This means that the most important summer destinations for German holidaymakers are approaching their Pre-Corona levels: Greece, for example, only has a comparatively small gap of 16 per cent to summer 2019. The long-haul destinations Maldives and Dominican Republic have already managed to catch up with their former strength.

Another booking trend is that people are increasingly booking online. In February, one-third of all booked summer holidays are accounted for by the online travel portals of tour operators and OTAs - this corresponds to almost a doubling of sales compared to February 2019. Cumulatively, too, the coming summer season is already showing a positive balance in online sales (+8 percent).

Since the beginning of the year, booking sales have increased from week to week and reached their (temporary) peak in mid-February (week 7). From week 8 onwards, at the finale of the carnival and coinciding with the start of the war in Ukraine, new bookings have declined by up to 30 per cent, yet the weekly volume of new bookings still exceeds the pre-Corona level in 2019. Therefore, the cumulative summer minus of 38 per cent to the current booking level can be expected to melt down even further. The extent to which the war in Ukraine and the sharp rise in energy prices will continue to affect the good holiday mood cannot yet be estimated at this point in time.

Legend:

The chart shows the cumulative travel sales generated up to the end of February 2022 for the 2022 summer season and the 2021/22 winter season in comparison to previous years (2019 and 2021 summer and 2018/19 and 2020/21 winter seasons). For the travel seasons, TDA compares the booking status adjusted for trips that were cancelled in previous years due to corona. Both holiday travel bookings in stationary travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month February that is attributable to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03