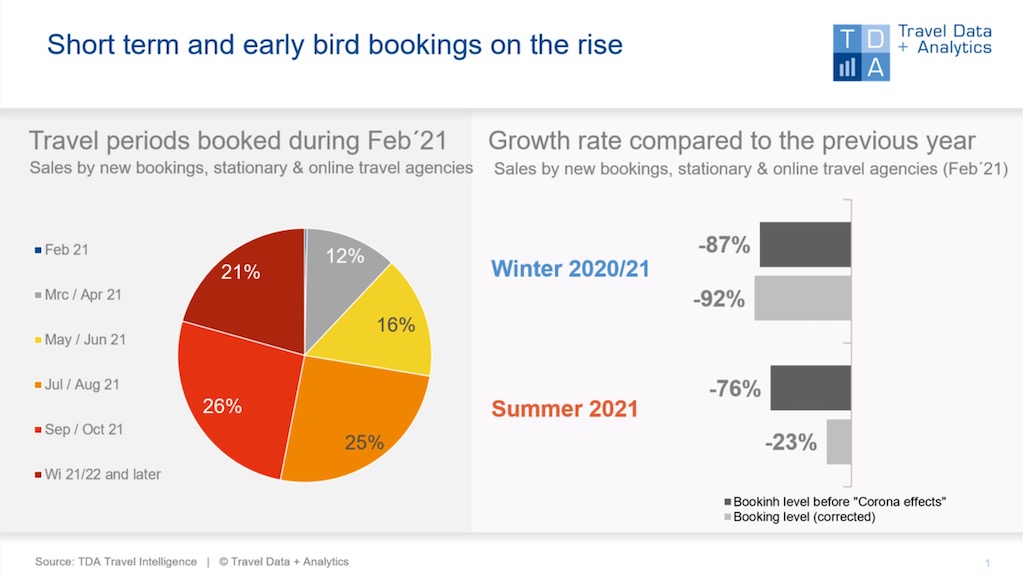

Nuremberg, 01 April 2021 – In mid-March, when the travel warning for the Balearic Islands was lifted, the holiday travel business showed a considerable PLUS on bookings. In February 2021, bookings remain still at a low level, although the first significant increase in bookings for the upcoming summer season is already becoming apparent in the middle of the month. The current seasonal balances for the booking status at the end of February: The summer season 2021 is cumulatively 76 percent below the previous year in terms of turnover - not adjusted for the holiday trips cancelled later. For the winter season 2020/21, which is still running, there are negative sales in February because trip cancellations exceed new bookings (cumulative status: -92 percent).

Apparently, slight hopes of a first holiday at Easter have spread in the course of February: the booking volume for the departure months March/April has increased by five percentage points compared to the previous month. However, the huge part of consumers is opting for later travel dates: Almost half of the booking turnover in February is accounted for by the autumn travel season. Accordingly, the sales figures for the travel months of September (-36 per cent) and October (-22 per cent) show the comparatively lowest losses compared to the previous year. It is obvious - early bird bookings for the coming winter season 2021/22 are on the rise: The share in sales turnover of 21 per cent corresponds to an increase of three percentage points compared to the previous month. However, early booking sales are still a long way from reaching their Pre-Corona level: at the current booking level, they are cumulatively 49 per cent below the previous year.

However, there is little change in consumers' booking preferences for the coming summer holiday. In terms of tour operator bookings, destinations in the eastern Mediterranean are the most popular (share of turnover: 37 per cent) followed by holiday regions in the western Mediterranean (share of turnover: 22 per cent). Compared to the previous month, earthbound tours have increased. Accordingly, Germany, Austria and Greece present themselves with comparatively below-average declines for the coming summer. However, the same applies to all travel countries: the losses accumulated to date in the high double-digit range will hardly be compensated for even by a possible increase in short-term business.

Legend:

The chart shows the cumulative travel sales generated up to the end of January 2021 for the winter season 2020/21 and the coming summer season 2021 compared to the previous year. Holiday travel bookings in stationary travel agencies as well as online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows what percentage of sales in the booking month January is attributable to the individual travel months or seasons.

Note: Holiday sales that have not been left due to cancellations by the organizers will be adjusted in the balance sheets at TDA Travel Intelligence at the end of the respective travel month. As of now, this affects all trips cancelled until the end of January 2021.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. Current booking situation + individual product performance = new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03