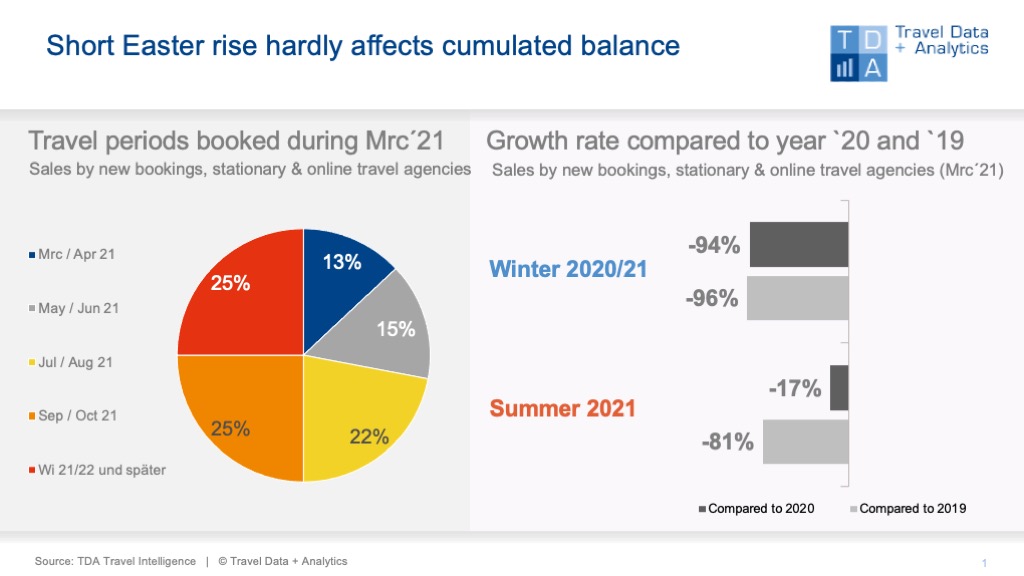

Nuremberg, 30 April 2021 - The opening of the Balearic Islands for holiday travel led to a visible increase in travel bookings in March - but only for a short time: Empathic appeals from politicians to German citizens not to travel set an immediate end to the small upswing. Nevertheless, the booking turnover generated in the monthly balance is better than in the previous month (+31 per cent). Compared to March 2019, the benchmark to pre-Corona levels, the declines remain striking. Cumulatively, the upcoming 2021 summer season sums up to a minus of 81 per cent at the booking level as of the end of March compared to summer 2019.

Compared to summer 2020 - adjusted for holidays cancelled or rebooked during the season - the decline is more moderate at minus 17 percent. Compared to the previous month, this corresponds to an improvement of five percentage points. Since the number of new bookings has exceeded the previous year's level since the 12th calendar week, it is to be expected that the gap to last year's summer season will continue to shrink. Compared to 2019, the volume of new bookings in the past four weeks since calendar week 12 (22 March to 17 April) is almost one-third of what was booked for organised holidays before the pandemic.

The still ongoing winter season 2020/21 has hardly been positively influenced by the small Easter travel in March/April - the volume is too small, the sum of other foreign trips, which remain unchanged due to travel warnings, is too large. At the current booking level, the winter season shows losses of 94 per cent compared to the previous year, in which trips were already cancelled at the end of the season (-96 per cent to winter 2018/19). This corresponds to almost a total loss of the travel season and thus already about one third of the total revenues that are definitely lost for the current tourism year 2020/21.

What the short-lived increase in bookings after the opening of the Balearic Islands impressively shows: many German citizens are obviously longing for some holidays after months of lockdown. Travel bookings for the Balearic Islands more than tripled in the booking month of March compared to the previous month. However, they are still far from comparable to the pre-Corona level in March 2019 (-72 per cent). In addition to the significant increase in bookings for the Western Mediterranean region as a whole (+105 per cent), long-haul and cruise bookings also increased visibly in March compared to the previous month (+30 per cent). However, half of the total monthly turnover in March is attributable to later travel periods from September this year. "The travel trade must be prepared for two booking trends this year: Strong short-term business as soon as destinations open and become available again and, at the same time, early bookers who, to be on the safe side, are already planning for autumn and winter or beyond," summarises Alexandra Weigand, Director Sales & Consulting at Travel Data + Analytics.

Legend:

The chart shows the cumulative travel revenues generated until the end of March 2021 for the winter season 2020/21 and the coming summer season 2021 in comparison with the previous year and the year before. Both holiday travel bookings in stationary travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of turnover in the booking month of March accounted for by the individual travel months and seasons.

Note: With the booking month March 2021, Travel Data + Analytics additionally uses the year 2019 as a pre- Corona comparison, as bookings collapsed from mid-February 2020 and hardly any travel took place in the first lockdown.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03