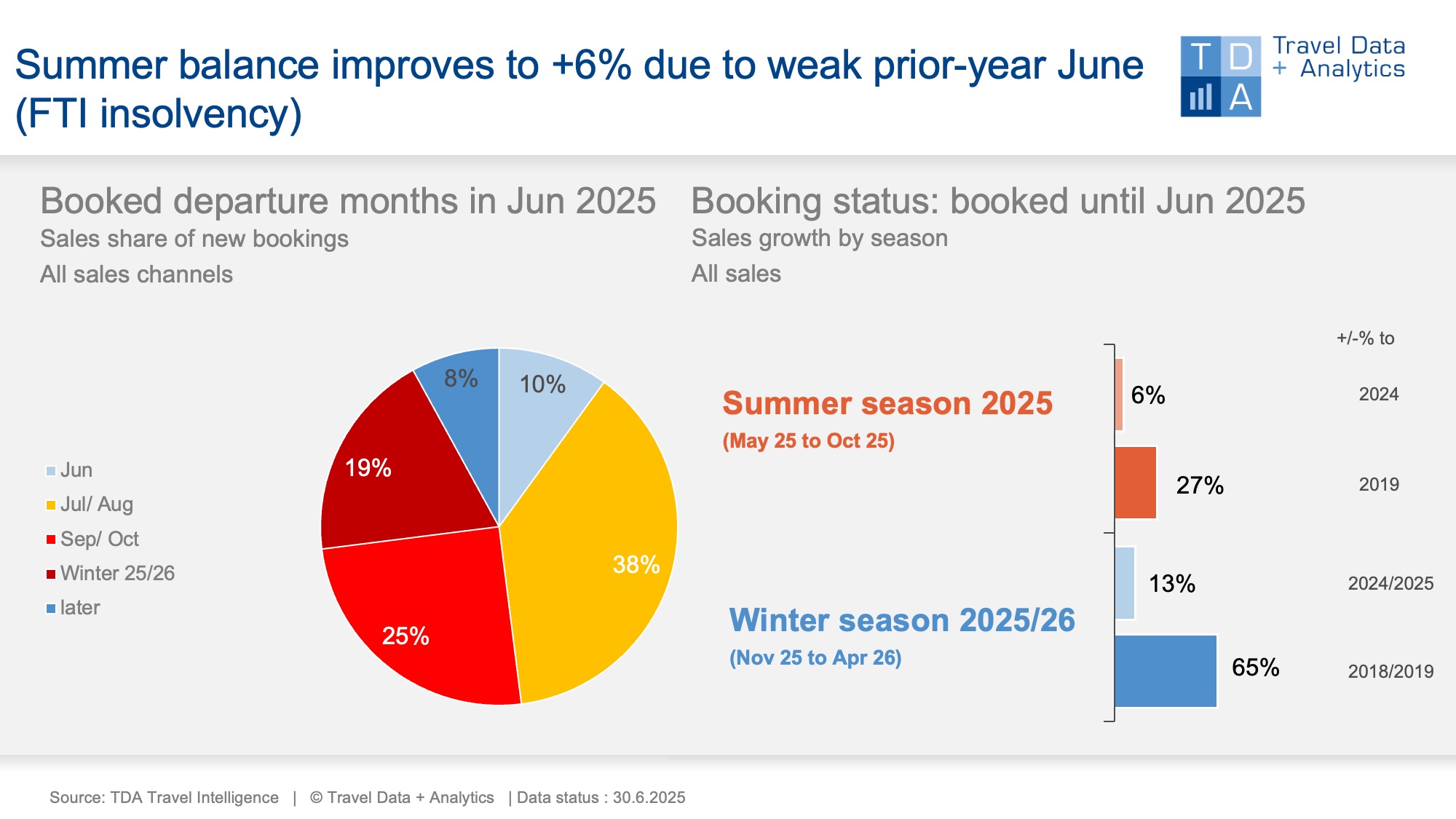

Nuremberg, July 31, 2025 – In June 2024, the FTI insolvency had a severe impact on sales statistics at the start of the summer holidays due to the cancellation of all the tour operator's holiday trips. This has led to a special effect in June this year, with some exceptionally high growth rates. Overall, the summer balance for 2025 rose by two percentage points compared to the previous month, resulting in a 6 percent increase in sales. The upcoming 2025/26 winter season is off to a good start in terms of bookings, with an 8 percent increase in the number of people booked and a 13 percent increase in sales. Here, too, the FTI effect plays a certain, but significantly smaller, role.

In June, the summer business is still in full swing: almost half of the monthly turnover in the past booking month is attributable to last-minute holiday bookings for the summer months of June, July and August. One in four holiday euros went towards the autumn holidays in September and October. In total, bookings received in June 2025 brought a 34 per cent increase in revenue for the current summer season because the cancelled holiday trips of the bankrupt tour operator FTI were adjusted in the same month last year. Cumulatively, the 2025 summer season gained two percentage points in terms of bookings at the end of June and currently shows a 6 percent increase in turnover compared to the previous year.

Even though replacement bookings for cancelled FTI holidays were unable to fully close the revenue gap caused by the insolvency in the previous year, this year's summer short-term business for many tour operators is running against a strong volume of new bookings last summer. In addition, new booking revenues since January of this year remain below the previous year's level (-4 percent through mid-July/calendar week 28). Nevertheless, this year's summer season is heading for a positive final result: including early bookers, German citizens had spent almost 13 billion euros on their package or modular summer holidays by the end of June 2025. This means that, measured against the total sales of last year's 2024 summer season, a fill rate of 84 per cent has already been achieved four booking months before the end of the season (previous month: 77 per cent).

Early bookers are proving to be a reliable factor in the holiday travel market for the new 2025/26 winter season: cumulatively, the coming winter travel half-year shows a 13 percent increase in sales compared to the previous year as of the end of June. The number of holidaymakers booked exceeds the previous year by 8 percent. The FTI effect, which must be taken into account in the good growth figures: Just under 10 per cent of FTI's sales booked in the same month last year were for early winter bookings made by the former third-largest tour operator.

For the upcoming 2025/26 winter season, long-haul trips in particular are performing above average in terms of bookings, with a 17 per cent increase in sales compared to the previous year. The most popular long-haul destinations are currently Thailand, the Dominican Republic, the Maldives and the United Arab Emirates. The USA is falling behind: for the coming winter travel half-year, it is currently 19 percent below the previous year's level in terms of revenue and 17 percent below in terms of booked holidaymaker numbers.

Legend:

The chart shows the cumulative holiday bookings generated by the end of June 2025 for the next winter season 2025/2026 and the current summer season 2025 compared to the previous year. TDA's analyses include holiday travel bookings in travel agencies as well as online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package holidays. The chart on the left shows the percentage of sales in the booking month of June accounted for by the individual travel months and seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03