Nuremberg, July 31, 2024 – The insolvency of FTI at the beginning of June this year has left a clear mark on the holiday travel business: After all of the tour operator's cancelled trips were adjusted in the sales statistics, the cumulative summer growth fell by 5 percentage points compared to the previous month of May. Although the volume of new bookings has visibly increased with the FTI insolvency, the volume of cancelled FTI bookings has not yet been compensated for. The new 2024/25 winter season, which begins with the travel month of November, has started with early bookings and strong growth.

Over 90 per cent of the FTI travel bookings that had to be cancelled due to the tour operator's insolvency relate to holiday trips in the current 2024 summer season. The impact of FTI's market exit is therefore much stronger in this year's summer business than for the upcoming 2024/25 winter season. While the summer season still showed a cumulative increase in sales of 17 per cent compared to the previous year at the end of May, the current booking status at the end of June is still 12 per cent. A slight decline compared to the late booking summer of 2023 was to be expected, but the larger share documents the cancelled FTI holidays. The volume of Germany's former third-largest tour operator cannot be compensated for so quickly. ‘By the time the reimbursement process of the German Travel Guarantee Fund starts, the summer holidays will be over. As not every household, especially family households that rely on the holiday periods, could afford an alternative holiday booking in a hurry, we assume that the FTI insolvency will definitely leave a gap in summer growth for tour operators in 2024,’ comments Alexandra Weigand, Director Sales & Consulting at Travel Data + Analytics.

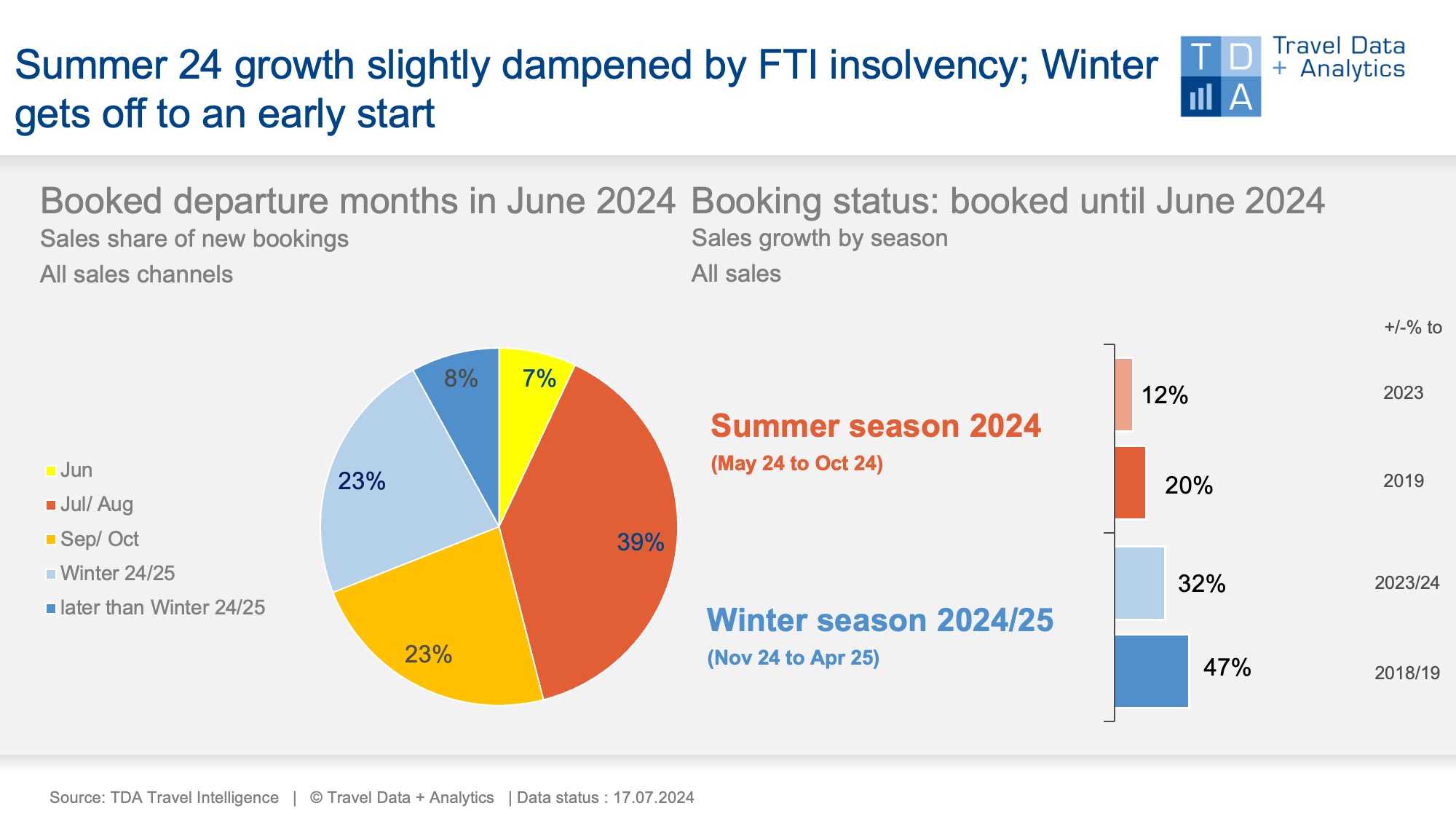

Almost half of booking turnover (46 per cent) in June 2024 is attributable to short-term travel bookings for the summer months of June, July and August. This means that the short-term share is slightly weaker than in the previous year (50 per cent). Turkey remains one of the most popular destinations, accounting for just under a quarter of monthly sales, but is experiencing a particularly sharp decline in growth due to the cancellation of FTI summer holidays: cumulatively, Turkey slipped from plus 37% at the end of May to plus 26% today.

The coming 2024/25 winter season has got off to a strong start in terms of early bookings and growth. In June 2024, almost one in four people in sales had already booked their winter holiday. This corresponds to an increase of a remarkable 5 percentage points compared to the previous year. Early bookers for summer holidays in the coming year or even later are responsible for 8 per cent of monthly sales, an increase of 3 percentage points. The upcoming 2024/25 winter season shows a cumulative increase in sales of 32 per cent compared to the previous year as at the end of June 2024. It has also managed to overcome the final hurdle: The number of people booked exceeded both the previous year (+31 per cent) and, for the first time, the pre-corona level of 2018/19 (+12 per cent). The holiday travel market in Germany is definitely back on the road to success despite FTI's withdrawal from the market.

Legend:

The chart shows the cumulative travel sales generated up to the end of June 2024 for the current winter season 2023/24 and the upcoming summer season 2024 in comparison to the previous seasons and the pre-corona level (summer 2019, winter 2018/19). TDA's analyses include both holiday bookings in traditional travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package holidays. The chart on the left shows the percentage of sales in the booking month of April accounted for by the individual travel months and seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03