Nuremberg, April 28, 2023 – The volume of new bookings in travel agencies and on the online travel agencies of tour operator products remains consistently above 2019´s levels. In the consequence the backlog of cumulated booking levels compared to pre pandemic years continues to disappear. Both the ongoing winter season 2022/23 and the upcoming summer season 2023, both seasons are at this stage of the year only four percent below the pre-Corona level. Compared to the booking levels by end of February, this corresponds to an improvement of three and five percentage points, respectively. The travel months of April and May over Easter and Pentecost are particularly strong in terms of sales and growth. The total revenues generated in travel sales in the booking month of March 2023 exceed the same month last year by 25 percent and March 2019 by 39 percent.

The growth in sales is higher than it would be only by increased travel prices and spending behavior. On average, Germans have spent around for prebooked services 15 percent more on their summer holidays than last year. The development of bookings shows an unchanged good demand for this year´s holidays in the German market. Compared to the previous year, the increase in the booked volume of trips is 23 percent. Compared to the pre-Corona level, however, there is still a striking gap: Compared to the 2019 summer season, 27 percent fewer people have booked a tour operator trip so far.

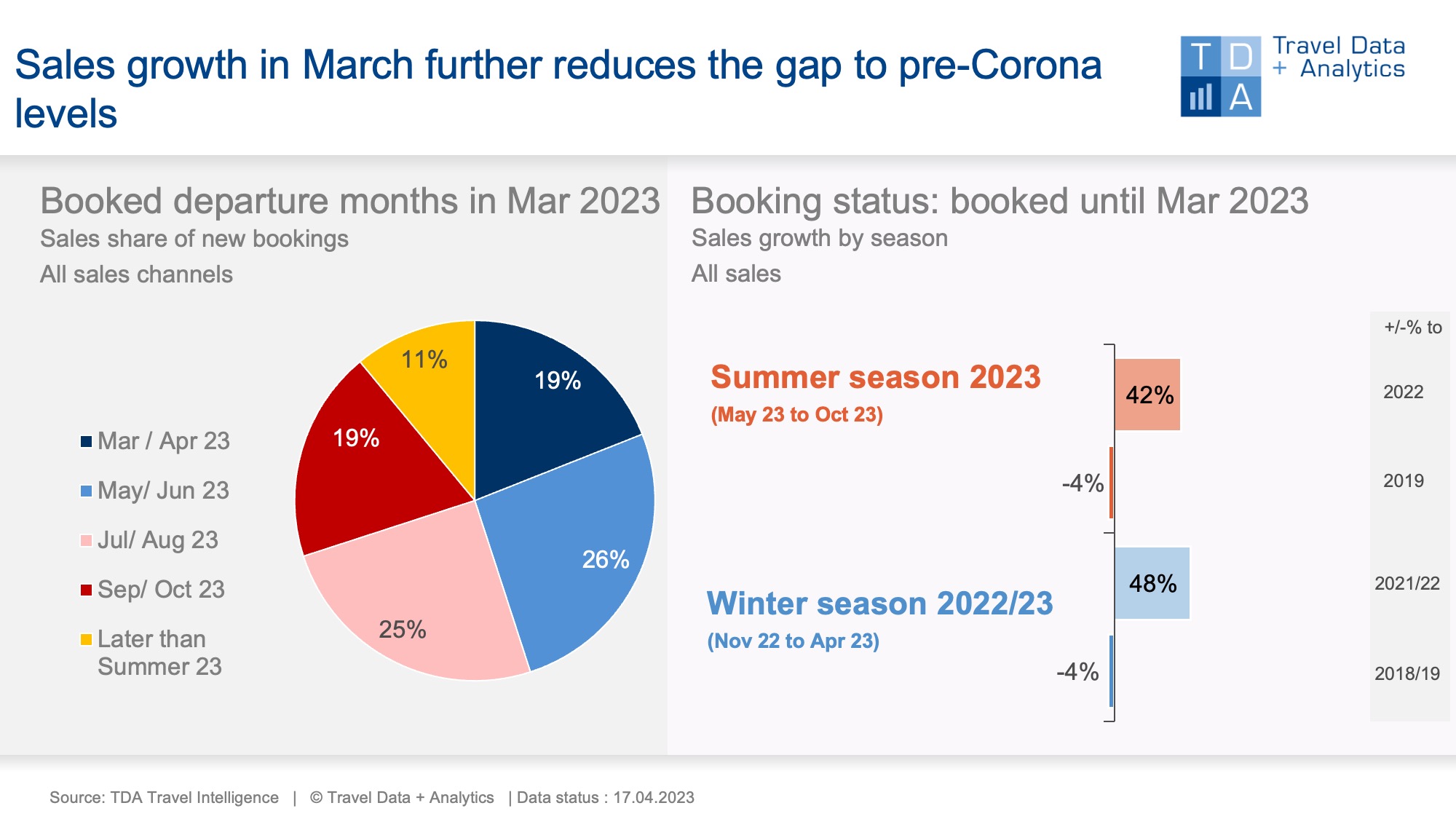

In March 2023, short-term travel bookings accounted for just under a fifth of monthly sales (19 percent), most of it during the Easter holidays in April. The travel month of April is the first and only travel month of this winter season, which even shows growth compared to 2019 (+3 percent). This year's Easter month accounts for a quarter of total winter sales in the 2022/23 season. In addition, around one in ten euros in sales in March 2023 will already go to the next winter season 2023/24, which begins with the travel month of November 2023. Early bookers are increasingly finding their way back to old habits.

The Spring break month of May is also well booked, accounting for around one-fifth of the summer sales achieved so far, with a 64 percent increase in sales compared to the previous year. In total, 70 percent of March sales are attributable to summer vacations. Cumulatively, the 2023 summer season thus has 42 percent more turnover compared to the previous year at the current booking level. In addition to the travel month of May, the bookings for autumn months of September and October are particularly fast-growing. However, the cumulative positive gap over the previous year will now continue to melt away: Last year, holiday bookings started later than usual due to corona and were therefore above average in the spring and summer months. Since the beginning of April, the current new bookings have not kept pace with the previous year.

Legend:

The chart shows the cumulative travel sales generated up to the end of March 2023 for the ongoing 2022/23 winter season and the coming summer season 2023 in comparison to previous years (summer season 2019 and winter season 2018/19). For the travel seasons, TDA compares the booking status adjusted for trips that were cancelled in previous years due to corona. Both holiday travel bookings in high street travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month October that belongs to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03