Nuremberg, 31 December 2021 - The sharp rise in Corona incidences in November, the threat of the next wave of omicron and admonishing words from politicians are visibly leaving their mark on the leisure travel business. In November 2021, new bookings by German citizens fall to 56 per cent of what was booked for holidays before Corona in November 2019 (sales level in the previous month: 90 per cent). This means that bookings for the coming 2022 summer season are comparatively weak at the current booking level: The travel trade still lacks half of the turnover for the 2019 summer season (pre-Corona level). Only in mid-December do the booking figures start to rise again slightly.

Despite the increasing reluctance to book, the current winter season 2021/22 is proving relatively robust: cumulatively, it shows a comparatively moderate shortfall of 30 per cent in turnover in travel agency and online distribution with a focus on tour operator travel compared to the 2019/20 season at the booking level at the end of November 2021. However, the 2019/20 winter season was already characterised by massive losses at the beginning of the Corona pandemic towards the end of the season from around the end of February 2020. Comparing the current winter season with the 2018/19 season, which was still completely unaffected, the gap is 46 per cent. The holiday travel business in Germany is and remains strongly influenced by the pandemic.

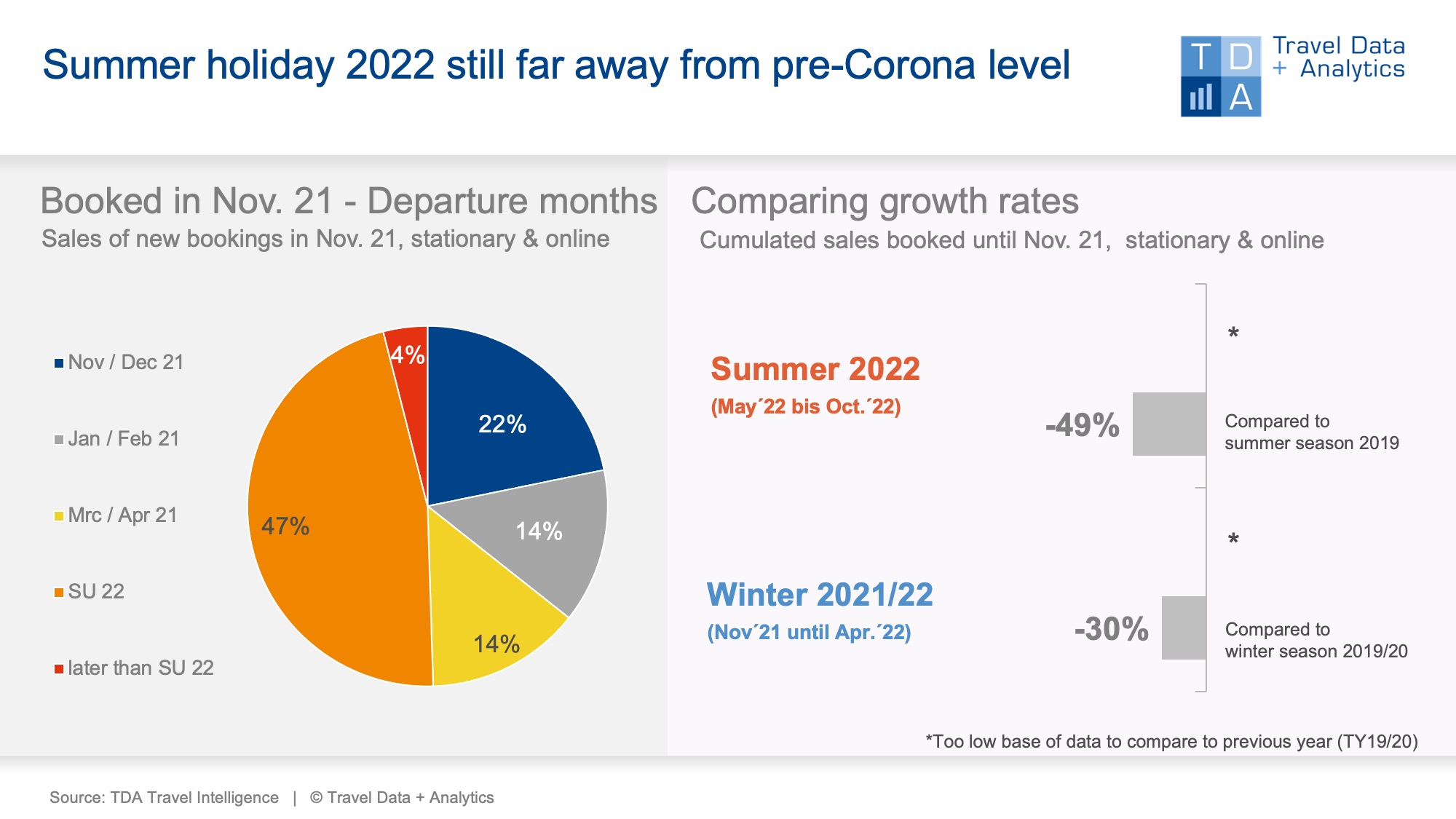

In November 2021, one in two people was still confident that they would be able to travel in the winter months from November 2021 to April 2022. In view of rapidly changing travel conditions, the short-term booking behaviour of German citizens remains pronounced. Holidays booked "last minute" with departure in November or December 2021 accounted for 22 per cent of the monthly turnover. For winter holidays, the Canary Islands, Egypt and the Maldives, the Dominican Republic, Turkey and the Emirates remain highly popular. At the current booking level, long-haul holidays account for 28 per cent of sales. The fact that the higher-margin long-haul tours have not been cancelled so far this winter, as in last year's winter, gives reason to hope for a better balance.

From the third quarter of a year onwards, summer bookings for the coming year usually increase visibly and reach their peak in January. In terms of turnover, summer holidays in 2022 account for 47 percent of turnover in November - but at a level that does not keep pace with the booking volume before Corona. Cumulatively, however, the turnover figures indicate that the pandemic-ridden previous summers of 2020 and 2021 can be clearly surpassed - even if the connection to the last "normal" summer season of 2019 is not yet successful at this point (-49 percent).

By the weekly sales analyses of data from the first half of December 2021, there is now to see a slight upward trend in holiday travel bookings at mid-month. It seems that the falling incidences, the booster vaccinations in the plan and the (not yet) noticeable Omikron wave are having a positive effect on booking behaviour. Summa summarum: The risks for the travel industry remain high, but small rays of sunlight are giving hope.

Legend:

The chart shows the cumulative travel revenue generated until the end of November 2021 for the summer season 2022 and the winter season 2021/22 compared to the previous year (summer 2019 and winter season 2019/20). For the travel seasons, TDA compares booking levels adjusted for trips cancelled due to Corona in previous years. Both holiday travel bookings in stationary travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month of November accounted for by the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03