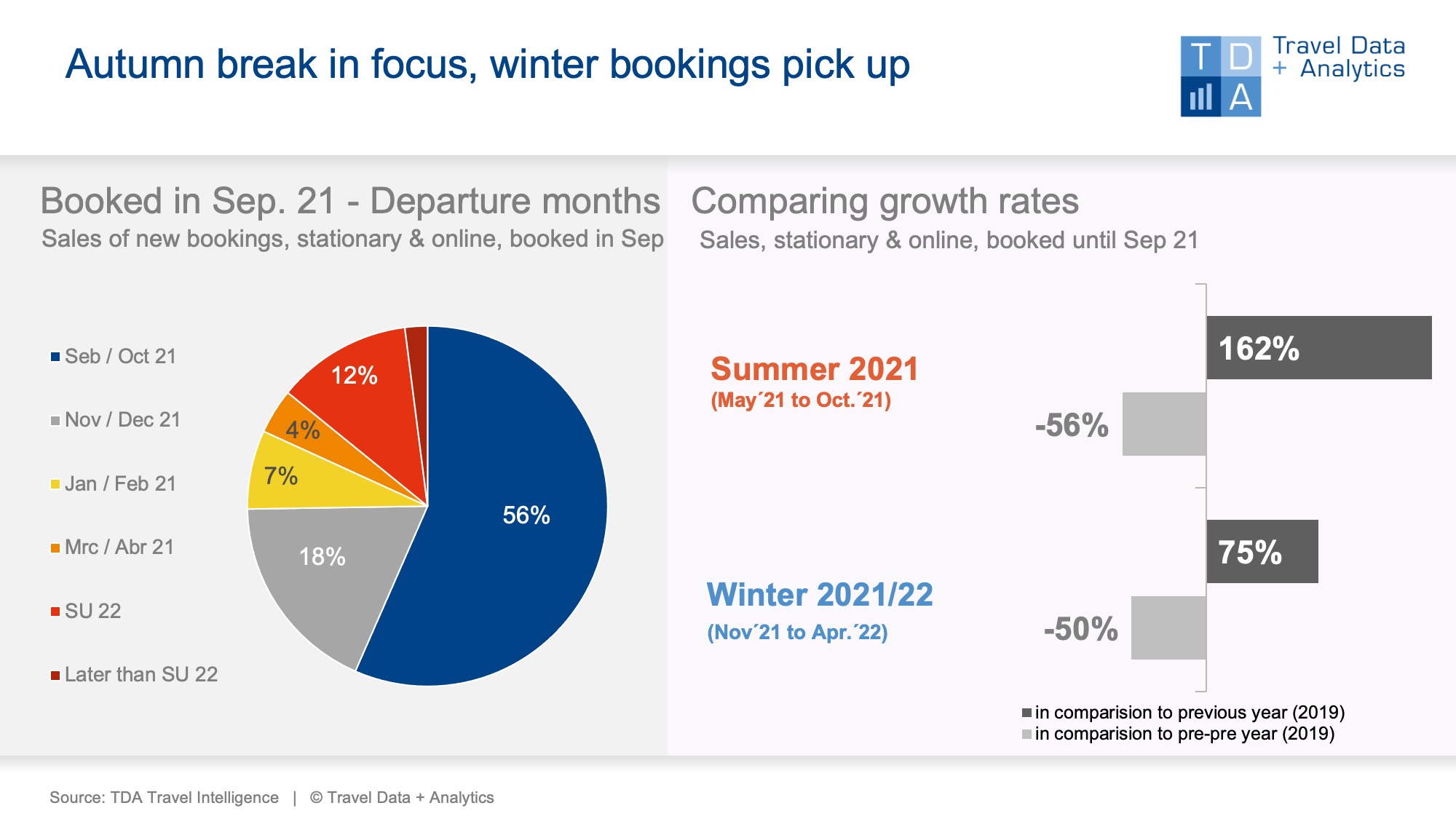

Nuremberg, 29 October 2021 - Holiday demand in the German market is relatively good: in September, the booking volume for tour operator holidays organised as packages is 6.8 per cent above the pre-Corona level in the comparable month of 2019. An above-average share of bookings is accounted for by short-term departures in the autumn months of September/October. This further improves the statistic of the 2021 summer season to minus 56 per cent compared to summer 2019 or an increase of 162 per cent compared to the previous year's summer 2020. Holiday bookings for the upcoming winter season are also picking up. The fact that popular long-haul destinations such as the USA or Thailand will open to tourists in November, according to the announcements, is noticeable in the booking volume.

Short-term holiday bookings were also in the focus of German citizens willing to travel in the past booking month of September. Travel in September and during the autumn holidays in October accounted for 56 per cent of the monthly turnover. The volume of travel booked at short notice exceeded the turnover level of 2019 by 48 per cent. This means that the balance of the 2021 summer season can improve by another three percentage points compared to the previous month. Nevertheless, the revenue losses compared to the pre-Corona summer 2019 remain high at 56 per cent. However, the figures of the previous year's 2020 season will be very significantly exceeded this year (+162 per cent).

The upcoming winter season 2021/22, which begins with the travel month of November, is currently still 50 per cent behind the winter season 2019/20 due to the persistently short-term booking behaviour. As the penultimate winter season was already characterised by corona-related travel cancellations towards its end in March and April 2020, Travel Data + Analytics compares the booking levels unadjusted in order to reflect the demand situation in a realistic manner.

In September, travel bookings for winter holidays increased visibly. In terms of sales, they have already reached almost 83 percent of the sales volume booked for tour operator travel in September 2019 and are thus slowly approaching the pre-Corona level. The accumulated deficit is thus expected to continue to shrink in the coming weeks - especially as more and more popular long-haul destinations return to the tourist map. When the USA announced its opening to tourists from November, the booking curve rose steeply. A similar increase in holiday bookings can also be observed for Thailand in the current weekly data. As soon as a popular long-haul destination becomes travelable again, bookings rise. This, together with the current overall positive holiday demand at or slightly above the pre-Corona level of 2019, gives rise to cautious optimism for the winter season 2021/22. Nevertheless, the risks for the travel industry remain unpredictable due to the approaching fourth Corona wave.

Legend:

The chart shows the cumulative travel revenues generated by the end of September 2021 for the 2021 summer season and the coming 2021/22 winter season in comparison with the previous year and the previous year. (A comparison with the previous year is not meaningful for the winter season, as almost all winter trips were ultimately cancelled between November 2020 and April 2021). Both holiday travel bookings in stationary travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of turnover in the booking month of August accounted for by the individual travel months or seasons.

Note: Since the booking month of March 2021, Travel Data + Analytics has also used 2019 as a pre-Corona comparison, as bookings collapsed from mid-February 2020 and hardly any travel took place during the lockdowns.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03