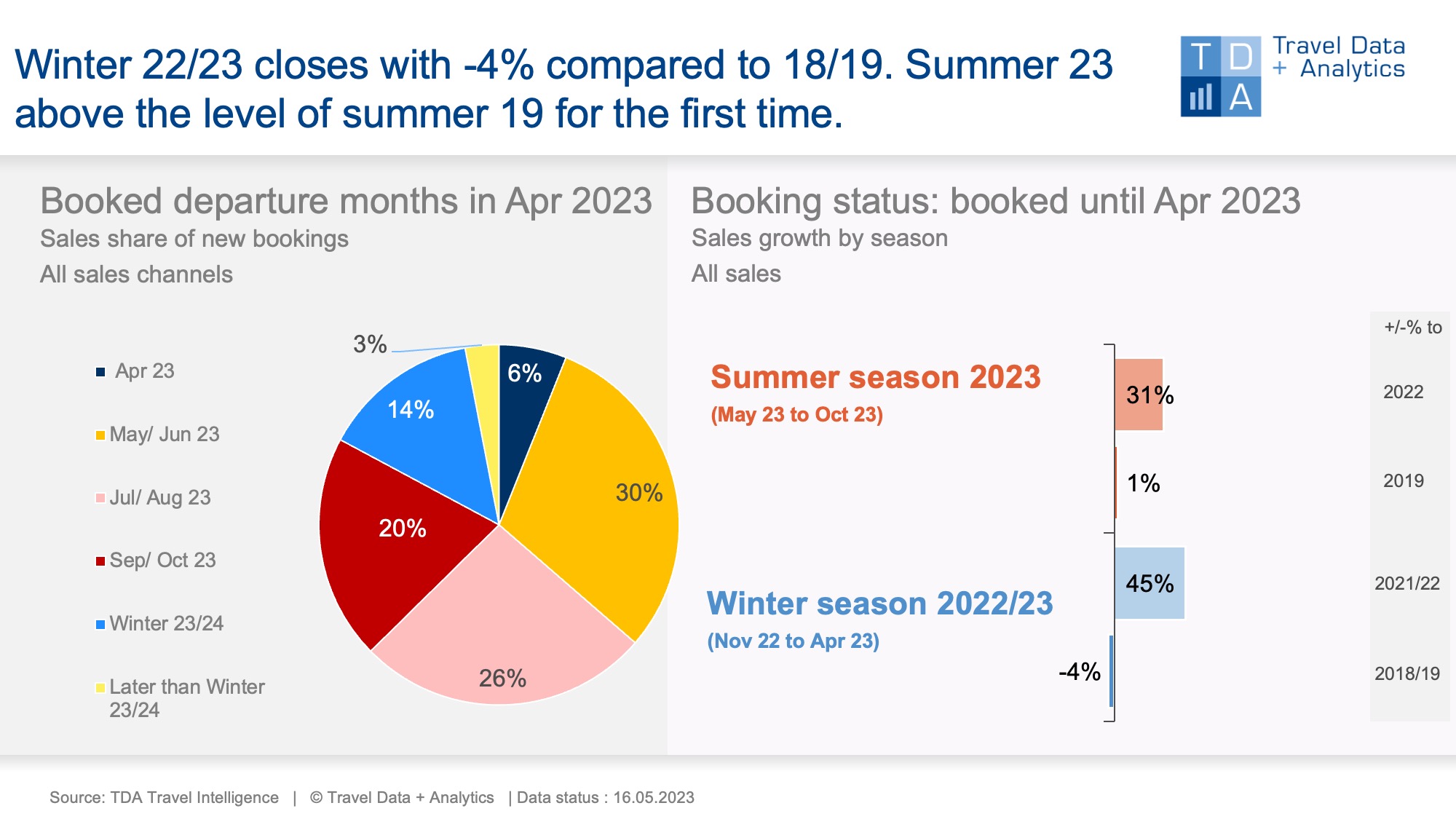

Nuremberg, May 31, 2023 – For the first time along the current booking period, the level of 2023 summer season has achieved a turnaround in bookings as of the end of April 2023. However, the small increase in sales of 1 percent compared to summer 2019 is still offset by 24 percent fewer holidaymakers booked. The 2022/23 winter season is now closed. As the seventh travel season in a row, it still fails to catch up with the pre-Corona level and ends with a minus of 4 per cent in sales. The booking turnover achieved in travel distribution in April 2023 does not keep pace with the previous year, in which travel bookings started relatively late due to Corona (-7 per cent). However, the 2019 sales level is still very clearly exceeded (+46 per cent).

6 per cent of the monthly turnover achieved in April 2023 in travel agencies and on tour operator online travel portals has still accounted for by tours booked at short notice in the Easter month of April. For the now closed winter season 2022/23, the last-minute sales in the last booking month were no longer sufficient to improve the balance: as in the previous month, the final result also shows a sales minus of 4 per cent compared to the pre-Corona level. Compared to last year, however, this year's winter season has shown a 45 per cent growth in turnover. The holiday business is visibly returning to normal, but neither long-haul travel nor cruises have yet fully regained their former strength - partly due to a lack of flight capacity.

The 2023's summer season, which has begun with the travel month of May 2023, is celebrating a first stage victory: as of the booking status at the end of April, it has already caught up with its previous level - at least in terms of turnover. As long as monthly booking turnover remains above the 2019 level, growth will continue. Only the lead over the previous year is now melting away, because the current holiday bookings are no longer keeping up with last year's rapid catch-up. While the increase compared to summer 2022 was still 42 percent in the previous month, it is already 11 percentage points less at the current booking level.

For this year's summer holidays, the travel destinations in the Eastern Mediterranean are very popular. At the current booking level, they account for around 44 per cent of the summer sales achieved so far. Turkey and Greece are in a neck-and-neck race, both with growth rates both compared to the previous year and to summer 2019. Turkey is slightly ahead with even greater growth. Egypt and Tunisia are also showing particularly strong demand and above-average growth in the region. Due to its immense importance in the German holiday travel market, Spain is often divided into the Balearic Islands, Canary Islands and mainland destinations. After all, however, Spain keeps the undisputed number 1 position for Tour Operator organized summer holidays in summer 2023 in Germany.

Legend:

The chart shows the cumulative travel sales generated up to the end of March 2023 for the ongoing 2022/23 winter season and the coming summer season 2023 in comparison to previous years (summer season 2019 and winter season 2018/19). For the travel seasons, TDA compares the booking status adjusted for trips that were cancelled in previous years due to corona. Both holiday travel bookings in high street travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month October that belongs to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03