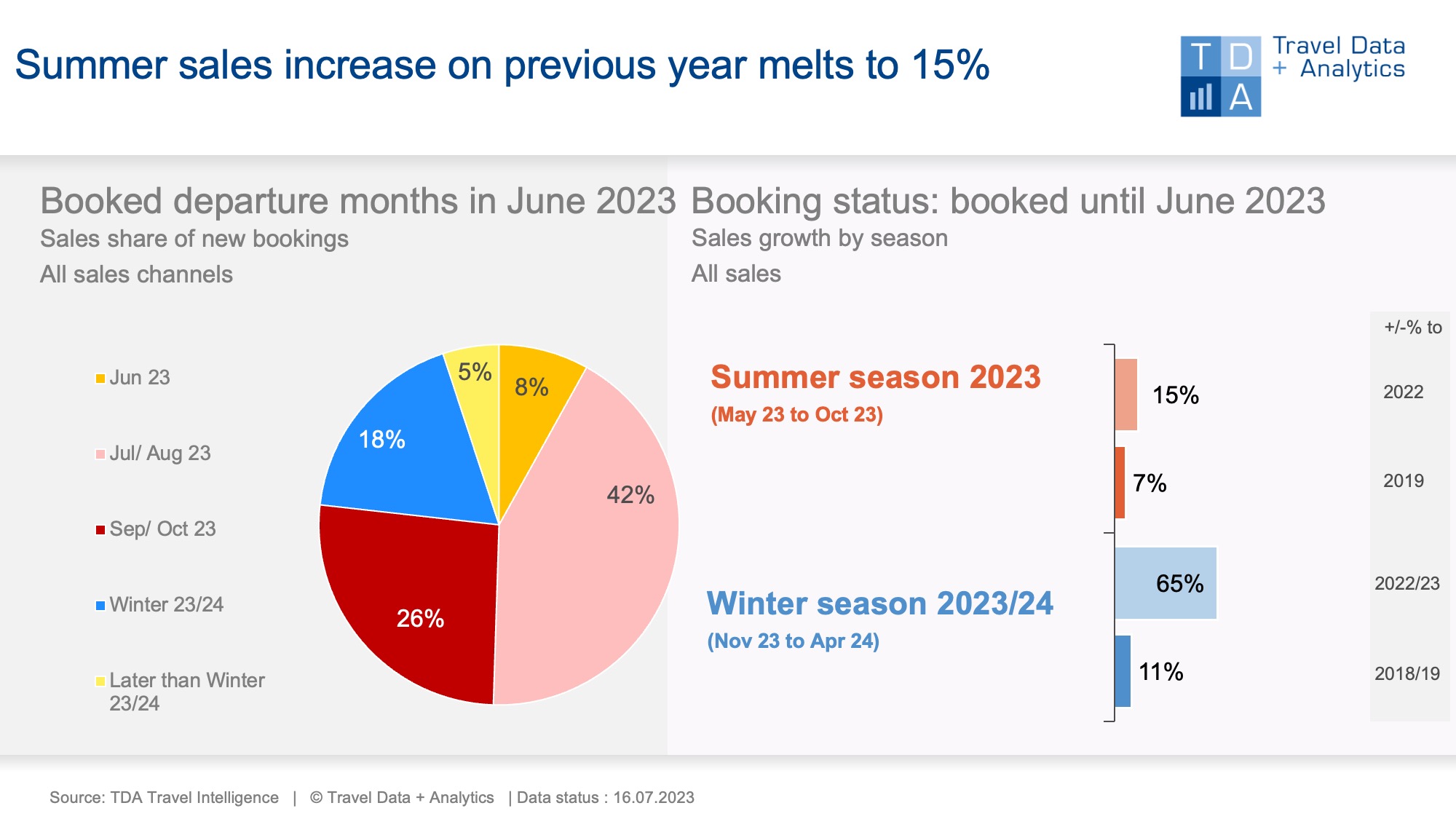

Nuremberg, July 31, 2023 – In June 2023, the booking volume for this year's summer vacations - as in April and May - remains below last year's strong short-term business (in sales: -14 percent). Cumulatively, the 2023 summer season still shows a 15 percent increase in sales compared to the previous year - 7 percentage points less than in the previous month. In terms of people booked, the early-booking plus has now been used up: At this point in time, just as many German citizens have booked a tour operator trip for their summer vacation as in the previous year; compared to 2019, there is a shortfall of 18 percent. For the new winter season 2023/24, bookings are off to a good start and show a cumulative increase in sales of 65 percent compared to the previous year.

The summer business is still in full swing: Half of the monthly sales in June 2023 were due to last-minute and last-minute vacation bookings for the summer months of June, July and August. Another quarter was booked for the fall months of September and October. Cumulatively, German travel sales for the 2024 summer season were up 15 percent on the current booking level at the end of June. The higher sales are due to increased vacation prices and the spending behavior of holidaymakers: At this point in time, the number of people booked for tour operator holidays is almost identical to the previous year. Revenue growth compared to pre-Corona summer 2019 has grown to 7 percent - up 4 percentage points from the previous month while booking 18 percent fewer people.

The booking season for the upcoming 2023/24 winter season, which begins with the travel month of November, has got off to a quite promising start: In travel agencies and on the online travel portals of tour operators and OTAs, 39 percent more sales of winter vacations were generated in the booking month of June than in the same month last year. Cumulatively, the new winter season stands at a 65 percent increase in sales over the previous year or 11 percent over pre-Corona levels. At this early stage, early-booking travel segments such as long-haul travel and cruises are disproportionately well represented: Together, they account for over 60 percent of winter sales to date. At country level, strong demand is emerging for the two most important winter destinations, the Canary Islands and Egypt.

Overall - i.e., the current summer season, the upcoming winter season, and later travel periods taken together - vacation travel sales generated in June 2023 are 45 percent higher than in June 2019. This suggests that, despite higher travel prices, vacation demand in the German market will remain at a high level overall. This is also supported by the fact that new bookings between the end of June and mid-July are once again significantly higher than in the comparable periods of 2022 and 2019.

Legend:

The chart shows the cumulative travel sales generated up to the end of June 2023 for the ongoing summer season 2023 in comparison to previous years (summer season 2019). For the travel seasons, TDA compares the booking status adjusted for trips that were cancelled in previous years due to corona. Both holiday travel bookings in high street travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month October that belongs to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03