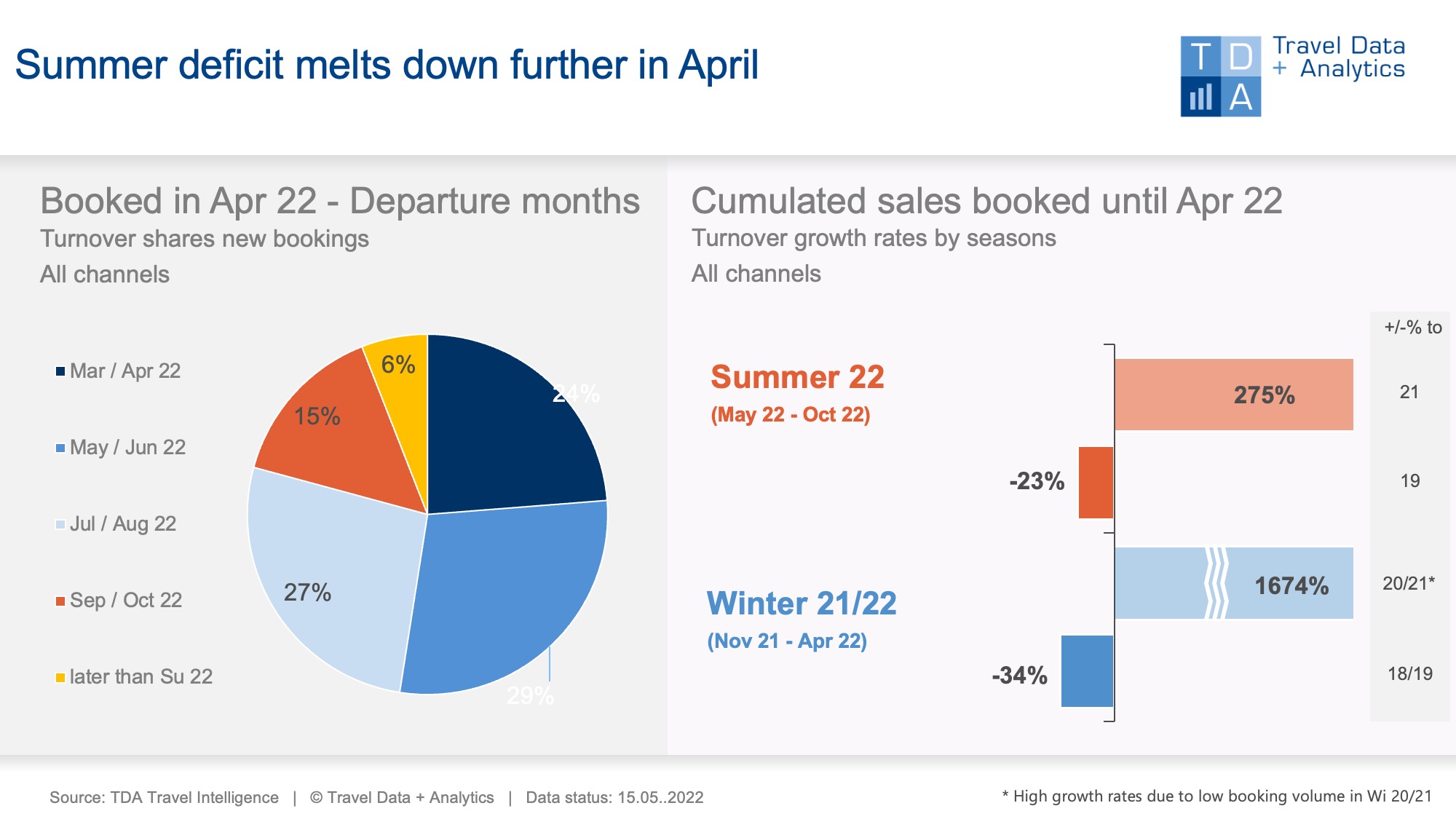

Nuremberg, 25 May 2022 – The desire and spendings of Germans for summer holidays is unbroken: In April, they booked holiday trips for around 1.6 billion euros in travel sales. The number of bookings thus exceeds the pre-corona level from April 2019 by a remarkable 57 percent. Most of the summer holidays are currently booked. The backlog of the 2022 summer season is melting by nine percentage points compared to the previous month to a cumulative level of now minus 23 percent. The lack of early bird sales from the winter months, which are still dominated by the pandemic, is increasingly being compensated. The 2021/22 winter season, which ends with the months of April, have closed with around a third less turnover than the pre-pandemic level.

With a revenue share of almost 80 percent, Germans mainly booked in April 2022 trips for their summer holidays. Around a third of the booking volume is accounted for by relatively short-term departures in May and June. So many have quickly secured a holiday over the holidays of Ascension Day and Pentecost. Overall, the number of bookings remains well above the level of 2019. Since the beginning of the year, the sales balance for the summer season 2022 has been improving from minus 50 percent to currently minus 23 percent as of the end of April. What stimulates the revenue growth? Rising expenses: For a seven-day trip including flights, for example, holidaymakers pay an average of 11 percent more than in 2019.The higher expenditure results from two factors: rising prices on the one hand, but on the other hand an increased willingness to spend more. After about two years of pandemic, many are simply treating themselves to something more this year.

In April, cruise bookings increased significantly, too - more than doubling compared to the previous month and with a considerable revenue growth compared to the pre-Corona level in April 2019. The cruise market segment seems to going on on its recovery course. Holiday bookings to Turkey are also rising sharply – by 31 percent compared to the previous month. After Spain, Greece and Turkey are by far the most booked destinations of summer 2022.

However, the winter season 2021/22 has also improved month by month since the beginning of the year although the lack of holiday trips from the winter months and above all the lack of long-distance trips and cruises could finally not be compensated. The now expired winter season 2021/22 ends with 34 percent less sales than in the winter of 2018/19 and thus slightly above the level of the winter of 2019/20 (+5 percent), when the holiday business began to collapse with the outbreak of Covid-19 in the spring. The proportion of winter holidays booked online in the 2021/22 season increased significantly to 36.5 percent (share 2018/19: 21.5 percent). In online travel sales, the winter balance sheet even shows an increase in sales of 13 percent.

Legend:

The chart shows the cumulative travel sales generated up to the end of April 2022 for the 2022 summer season and the 2021/22 winter season in comparison to previous years (2019 and 2021 summer and 2018/19 and 2020/21 winter seasons). For the travel seasons, TDA compares the booking status adjusted for trips that were canceled in previous years due to corona. Both holiday travel bookings in stationary travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month March that is attributable to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03