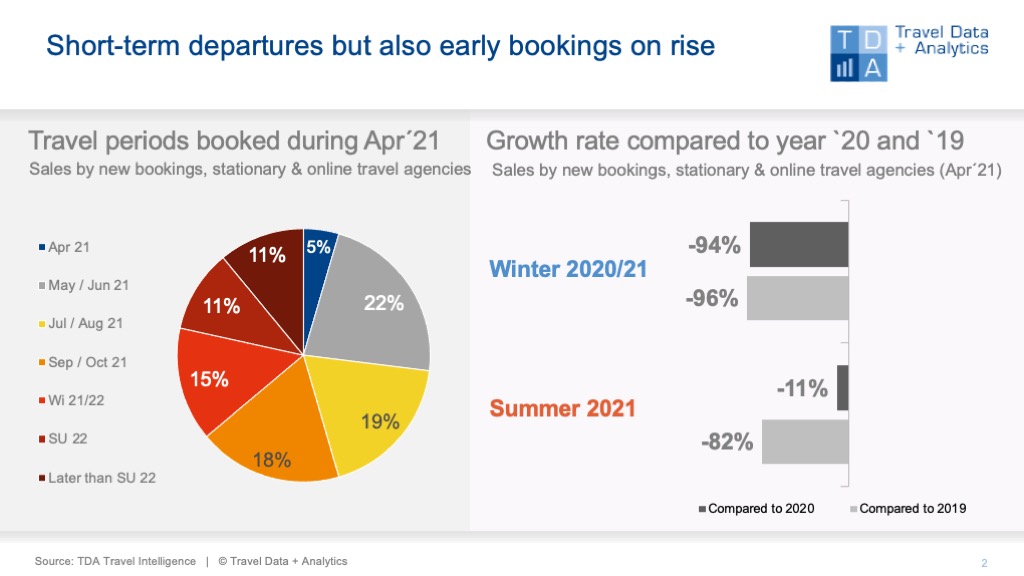

Nuremberg, June 1st, 2021 - In April 2021, the vacation options were still very limited and a “normal” leisure trip seemed far away: it was only at the end of the month that the first openings in popular travel destinations became apparent. Nevertheless, the shorter-term travel bookings for May and June are already picking up in April - accounting for 22 percent of booking turnover (previous month: 15 percent). Cumulatively, the 2021 summer season shows a minus of 11 percent compared to the previous summer compared to the booking status at the end of April 2021. Compared to the summer of 2019, however, only under 20 percent of the seasonal turnover has been booked.

The winter season 2020/21 closed at the end of April with the sobering result: A minus of 96 percent of sales volume compared to the 2018/19 winter season and 94 percent compared to the previous winter, which had to cope with the first losses towards the end of the season as a result of the corona pandemic.

However, the outlook for this year's summer season is more positive: The weekly new booking revenues are now increasing from week to week - in the third week of May (CW 20) they even exceed the sales level that was booked before Corona in the comparison period 2019. As early as April, the hopes of German citizens that a Whitsun vacation might be possible were growing. Short-term holiday bookings with departures in May and June accounted for 22 percent of monthly sales in April - seven percentage points more than in the previous month of March. In the last week of April and the first three weeks of May, this proportion increased visibly to up to 29 percent. Many German citizens wait on packed suitcases, so to speak, and take hold of them as soon as travel options and freedom beckon. For example, when the travel warning for the Dominican Republic was lifted, bookings immediately skyrocketed.

At the same time, the number of early bookers remains at a high share at sales. 37 percent of sales volume comes from bookings for the next winter season, the summer season 2022 or even beyond that. Compared to April 2019, this corresponds to an increase of a remarkable 17 percentage points. The early bird sales for travel in the new tourism year 2021/22 and later in the booking month of April, at -10 percent, were almost the same as in April 2019.

Legend:

The chart shows the cumulative travel revenues generated until the end of April 2021 for the winter season 2020/21 and the summer season 2021 in comparison with the previous year and the year before. Both holiday travel bookings in stationary travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of turnover in the booking month of March accounted for by the individual travel months and seasons.

Note: Since the booking month of March 2021, Travel Data + Analytics has also used 2019 as a pre-Corona comparison, as bookings collapsed from mid-February 2020 and hardly any travel took place in the first lockdown.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03