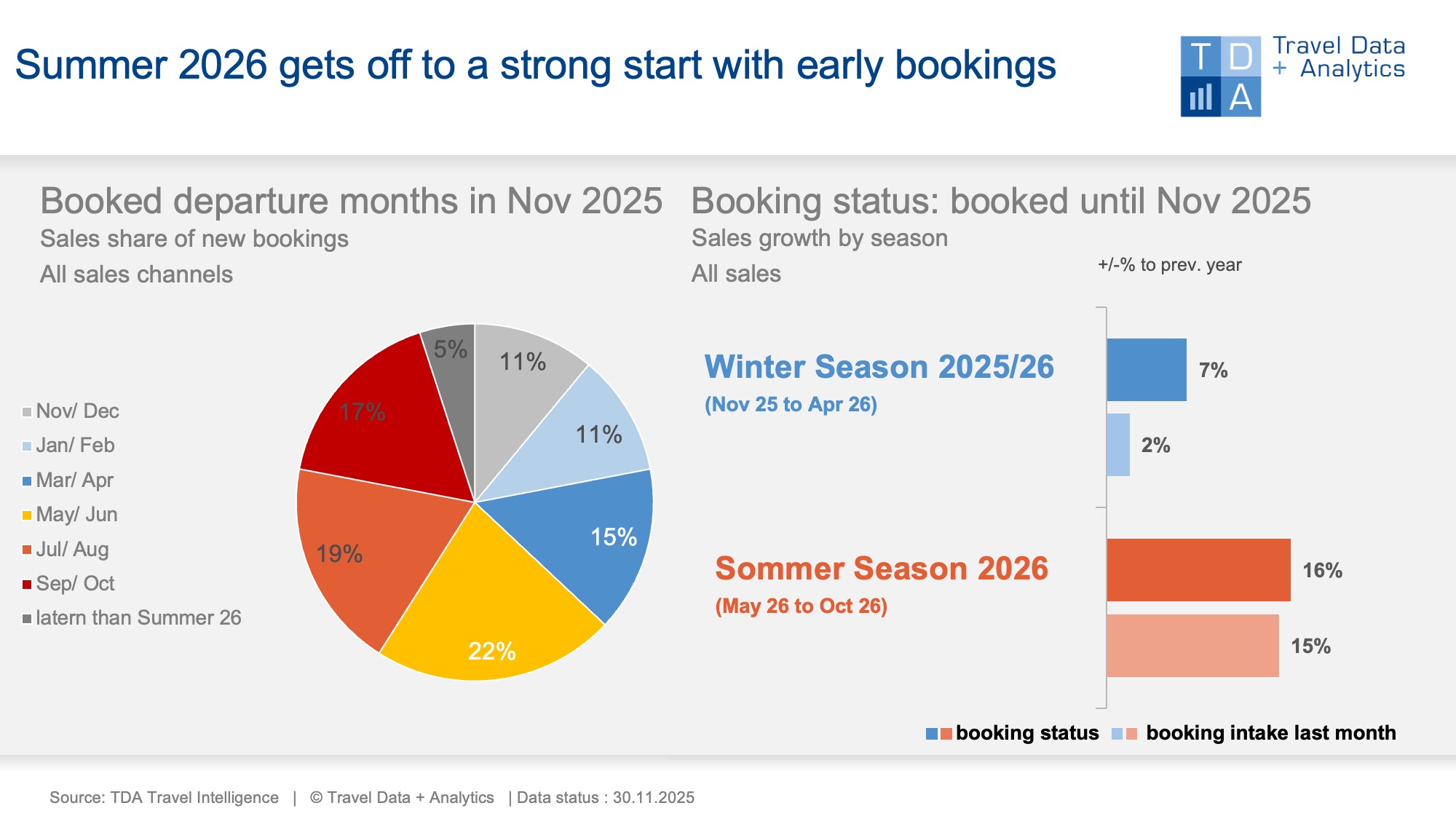

Nuremberg, December 29, 2025 – In November 2025, booking revenues exceeded the prior-year month by a total of 10 percent. The largest share of this growth, an increase of 15 percent, was generated by the summer season 2026, which already accounts for 58 percent of total holiday revenues booked in the organised travel market during the past booking month. As a result, summer holiday bookings have clearly overtaken winter holidays in importance.

Early booking demand continues to drive growth: at the current booking status, summer 2026 shows a cumulative revenue increase of 16 percent compared with the previous year. However, the strong performance of summer bookings in November has come at the expense of the newly started winter season 2025/26. Early bookers once again prove to be a reliable driver in the German leisure travel market. With an increase of 13 percent in booked traveller numbers and 16 percent in revenue, summer 2026 has entered the booking season with strong momentum. Destinations on the eastern mid-haul corridor stand out with significantly above-average growth (+22 percent). Türkiye is the number one summer destination among early bookers and, with a 23 percent increase, accounts for around one quarter of all tour operator bookings made so far for the coming summer. Egypt, Italy, mainland Spain, and Tunisia are also seeing particularly strong early demand.

In November, 58 percent of monthly revenues were generated by bookings for summer holidays in 2026. Since 2023, the revenue share of early bookings has increased by two percentage points per year. “As the booking season progresses, the initially strong early-booking cushion will gradually diminish. Based on experience from recent years, Germans are booking earlier – but ultimately not significantly more. Tour operators are releasing their seasonal programmes earlier and earlier, and travellers with fixed holiday plans and sufficient financial means are making active use of these opportunities,” explains Roland Gassner, Director Business Development at Travel Data + Analytics (TDA).

The strong early-booking growth for summer 2026 is impacting the current winter season 2025/26. While November booking intake for winter holidays shows only a modest 2 percent revenue increase, the cumulative winter revenue declines by one percentage point compared with the previous month. Nevertheless, the winter season still records a solid cumulative revenue increase of 7 percent, and the number of booked winter travellers remains 6 percent above the prior year. Measured against last year’s seasonal revenues, the current winter season has now reached a 71 percent booking level (previous month: 60 percent). For the upcoming summer season 2026, early bookers have already generated almost one quarter of the prior year’s total summer revenues.

Legend:

The chart illustrates the cumulative travel revenues generated up to the end of November 2025 for the current winter season 2025/26 and the upcoming summer season 2026, each compared with the previous year. TDA’s analysis includes holiday travel bookings made through brick-and-mortar travel agencies as well as online bookings via tour operator websites and Online Travel Agencies (OTAs), with a focus on package holidays. On the left side of the chart, the percentage share of November 2025 booking revenues attributable to each travel month or season is shown.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03