Nuremberg, April 30, 2025 – In March 2025, German citizens spent more than two billion euros on booking package holidays or holidays organised as modules. Compared to the same month last year, this corresponds to an increase in sales of 6 per cent. However, this growth is not due to the current winter season or the upcoming summer season, but is solely due to early bookers who are already securing their next winter or summer holidays for the coming year. Overall, the volume of bookings in the German holiday travel market this year has levelled off at the previous year's level. Reduced booking activities for the USA is clear to see in March.

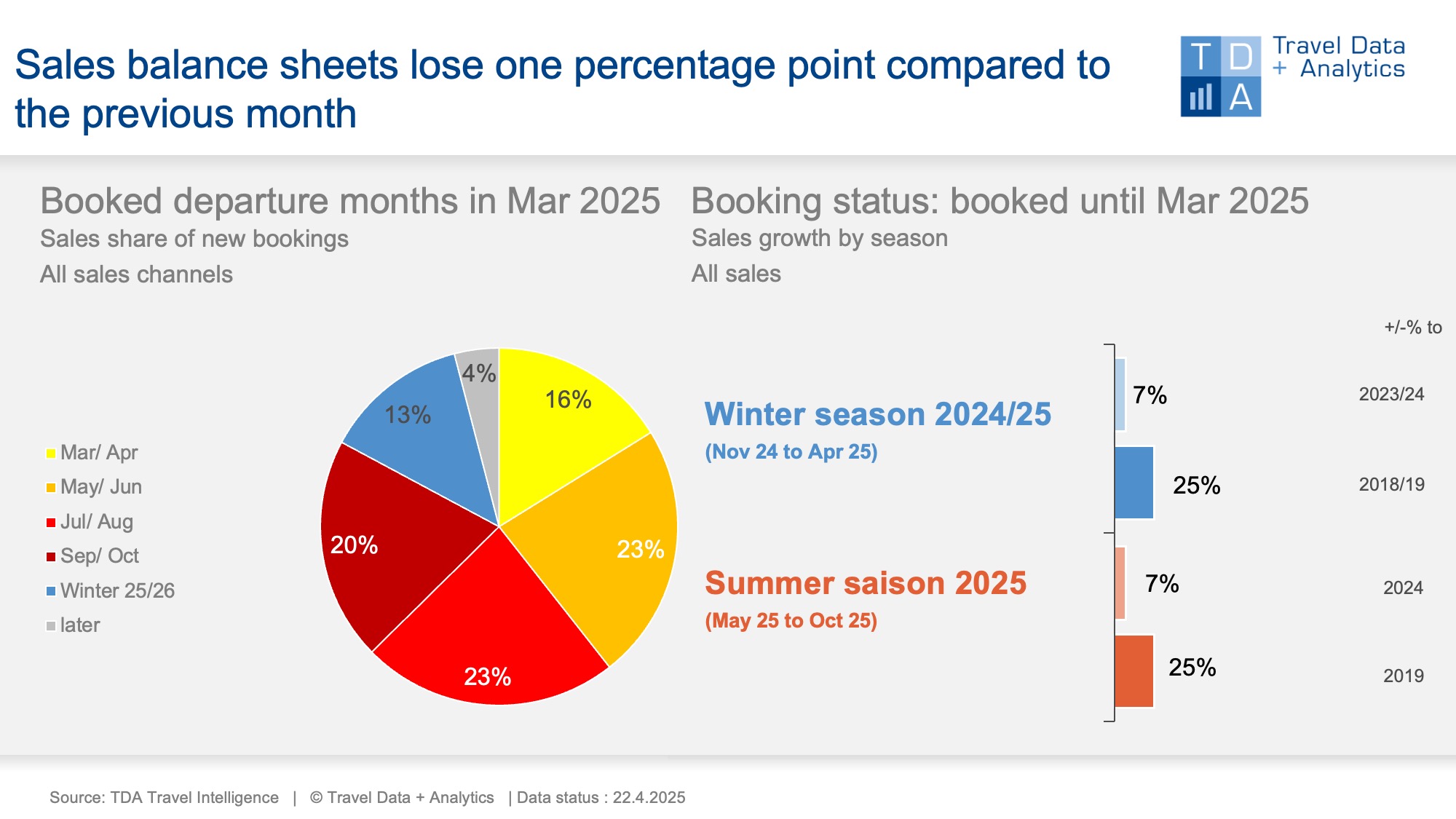

In March 2025, bookings for the summer season 2025, which will begin shortly, were at the same level as the previous year, while winter holidays booked at short notice for March and April were slightly lower. As a result, the current seasonal balances are down one percentage point on the previous month and show year-on-year growth of 7 per cent in turnover at the current booking status at the end of March. The winter season, which runs until the travel month of April, can no longer be affected by small deviations: It is already exceeding the final result of the previous year's 2023/24 season by 6 per cent. This year's summer season, which begins with the travel month of May, has reached a booking level of 61 per cent (previous month: 52 per cent). This means that travel sales with medium- and short-term summer travel bookings would still have to bring in around 40 per cent of the sales volume in order to match last year's summer: in view of stable holiday demand in the German market, this is a plannable target for the remaining booking months from April to October, even if the FTI insolvency shortly before the summer holidays last year gave an extra boost to short-term bookings.

In some weeks, this year's booking volume is higher than last year, in others it is lower: In total, Germans spent just as much on their holiday trips from January 2025 to the Easter weekend (week 16) as they did in the previous year. The number of travellers booking an organised holiday trip is also almost identical to the previous year. However, there is still a gap compared to the pre-corona level: In relation to the current tourism year 2024/25, which combines the 2024/25 winter season and the 2025 summer season, the figure is 12 per cent lower. The price increases are leaving their mark on the organised holiday travel market. For the upcoming summer holidays, comparatively inexpensive destinations such as Egypt and Bulgaria are in particularly high demand: in terms of bookings, Egypt is up 21 per cent on the current booking status, while Bulgaria can look forward to a 24 per cent increase in holidaymakers. In contrast, demand for holidays to the USA is currently slumping: Advance bookings for trips to the USA fell by 23 per cent in March 2025 compared to the same month last year. Cumulatively, the USA is currently down 11 per cent for summer 2025 compared to an increase of 9 per cent for long-haul travel overall.

Legend:

The chart shows the cumulative holiday bookings generated by the end of March 2025 for the current winter season 2024/2025 and the upcoming summer season 2025 compared to the previous year and the pre-corona level (summer 2019, winter 2018/19). TDA's analyses include holiday travel bookings in brick-and-mortar travel agencies as well as online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package holidays. The chart on the left shows the percentage of sales in the booking month of January accounted for by the individual travel months and seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03