Nuremberg, February 27, 2025 – In the booking month of January 2025, more than 3 million Germans booked their holidays this year in travel agencies and on traditional online travel portals and spent a good 3.3 billion euros. In terms of turnover, the German tour operator travel market was thus able to match the record figures of the same month last year (+1 per cent), but not in terms of people booked (-5 per cent). Nevertheless, the January balance sheet remains impressive because, like the current winter season, the upcoming summer season has already seen strong early bookings. Cumulatively, the current tourism year 2024/25, which includes both travel seasons, has seen an 11 per cent increase in sales compared to the same booking status at the end of January.

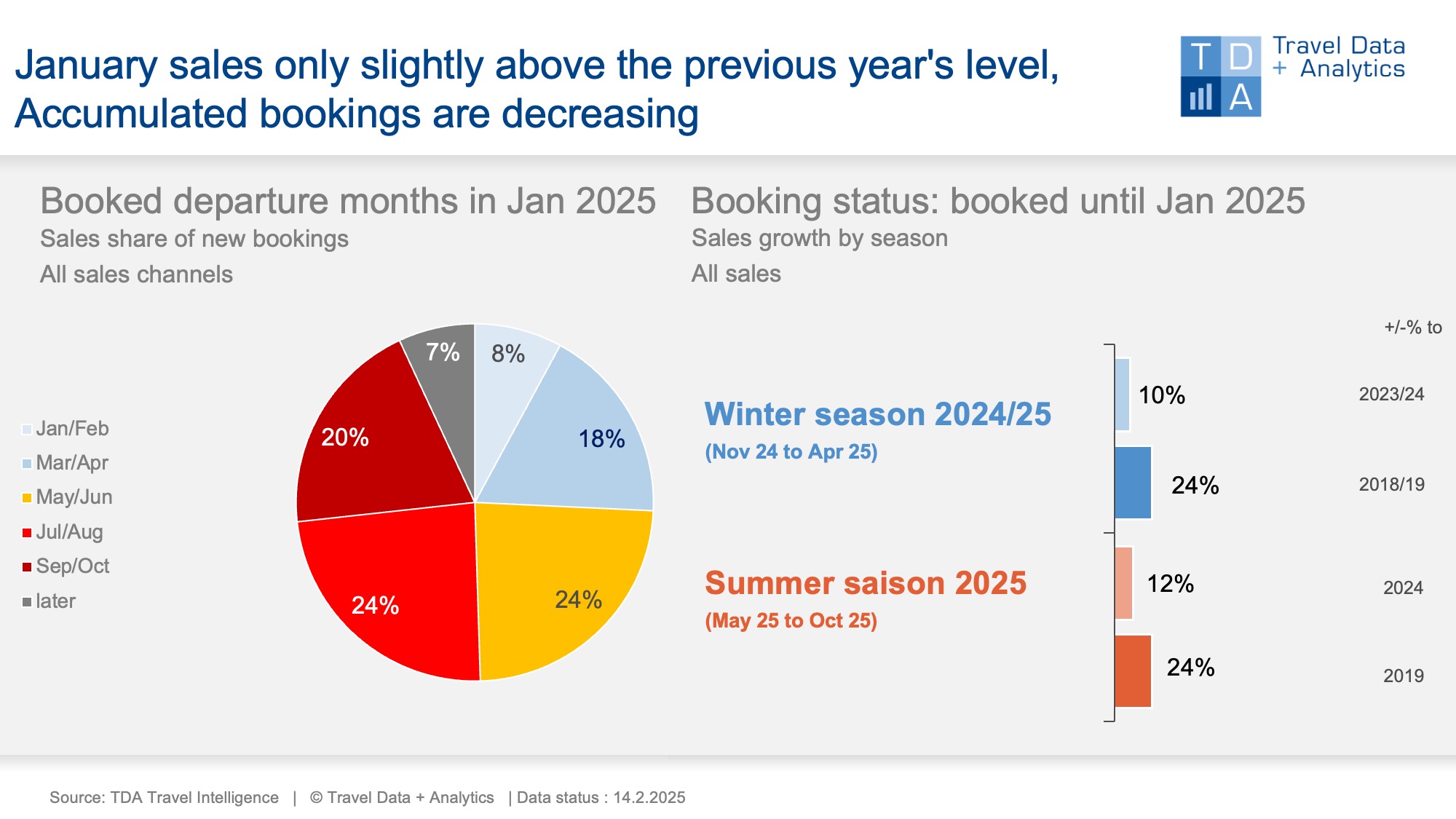

The outlook for the current travel year remains promising. Although the cumulative seasonal balances continue to shrink in view of the only small, 1 per cent growth in sales in January, the immense overall booking volume in the strongest month of the year in terms of sales ensures a comfortable starting position: the 2024/25 winter season, which runs until April, is currently showing a 10 per cent increase in sales compared to the previous year and 94 per cent of last year's total sales are already ‘in the can’ at this point in time - three booking months before the end of the season - already ‘in the can’ (previous month: 85 per cent). For the upcoming 2025 summer season, which only begins with the travel month of May, a fill level of 43 per cent has now been reached (previous month: 28 per cent). In a year-on-year comparison, the summer season still stands at a cumulative sales increase of 12 per cent, 6 percentage points less than in the previous month. With the return to normal early booking behaviour and declining price momentum, growth will slowly return to single-digit growth rates overall. However, the tourism industry is currently still faring much better than many other sectors in a slightly recessive economic situation in Germany.

In January, consumer interest in booking holidays focuses on the upcoming summer holidays, which account for a good two-thirds of sales. Winter holidays account for around a quarter of total sales and, unlike summer bookings (+2 per cent), were weaker than in the previous year (-3 per cent). As at the end of January, the volume of bookings for the coming summer months has already exceeded that of the current winter season as a whole. The holiday destinations in the eastern Mediterranean, cruises and long-haul holidays are the growth drivers in the current 2025 summer balance sheet with above-average growth.

Despite good growth and pleasing demand for holidays, one thought-provoking fact remains: Compared to the previous year, more people are once again taking an organised tour operator trip. The winter season still shows a small increase of 1 per cent, while the coming summer season is currently up 6 per cent. Compared to the pre-corona level, however, there is still a gap of 11 per cent (winter) and 12 per cent (summer). Although holiday prices are no longer rising as sharply as in previous years, travel is still tending to become more expensive and therefore less affordable for some German households. The overall economic situation also harbours risks for the tourism industry: increasing unemployment due to announced, in some cases massive, job cuts, the fear of job losses alone, would not remain without consequences for the holiday travel market sooner or later.

Legend:

The chart shows the cumulative holiday bookings generated by the end of January 2025 for the current winter season 2024/2025 and the upcoming summer season 2025 compared to the previous year and the pre-corona level (summer 2019, winter 2018/19). TDA's analyses include holiday travel bookings in brick-and-mortar travel agencies as well as online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package holidays. The chart on the left shows the percentage of sales in the booking month of January accounted for by the individual travel months and seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03