Nuremberg, September 26, 2024 – In the booking month of August 2024, Germans mainly booked their upcoming autumn holidays in September and October, followed by holidays for the coming winter season, in which cruises are once again very popular. Cumulative sales for the 2024 summer season are up 10 per cent year-on-year at the current booking level. This means that the final result for the previous summer has already been exceeded by 4 per cent. New bookings for tour operator holidays in the German market remain above the previous year's level.

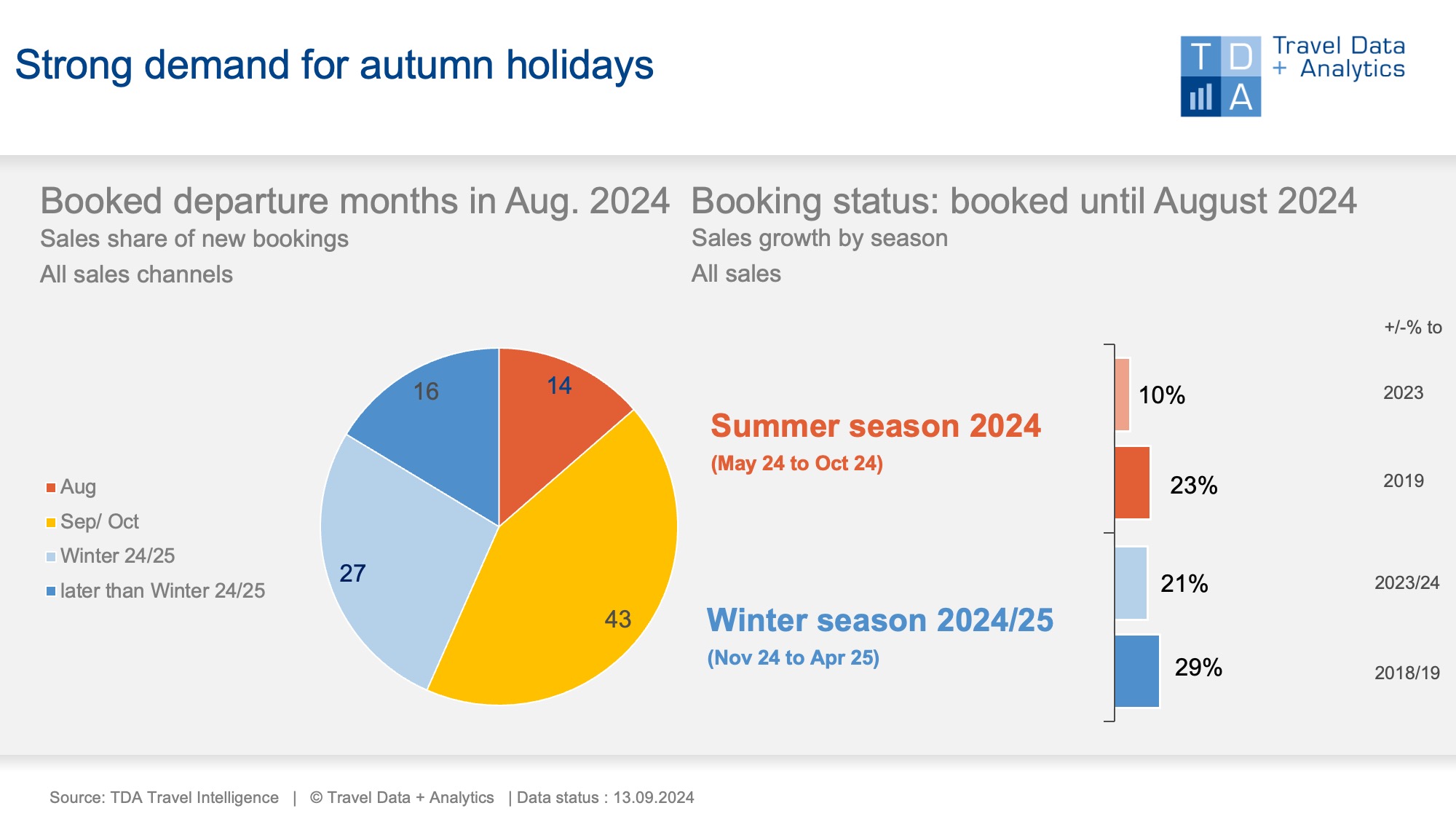

In August 2024, booking sales in German travel sales for the current summer season are slightly weaker (-2 per cent) and for the upcoming winter season slightly stronger (+4 per cent) than in the same month last year. In terms of sales, however, the proportion of holiday trips booked at short notice remains somewhat higher than would normally be the case in travel years without tour operator insolvencies or a pandemic. 14% of monthly sales are attributable to last-minute bookings for holidays departing in August and autumn holidays were the most popular in the past booking month, accounting for 43% of sales. Despite FTI's withdrawal from the market, summer 2024 is heading for a successful seasonal result. At the end of August, bookings had already exceeded the previous summer's total sales by 4 per cent.

In August 2024, bookings for winter holidays accounted for a slightly below-average share of sales of 27%. Nevertheless, cumulative bookings to date show promising growth compared to the previous year, both in terms of turnover (+21%) and in terms of people booked (+17%). Cruises are currently in particularly high demand for upcoming winter holidays, with sales up 28 per cent. No other form of travel is currently growing better compared to the previous year. Among tour operator tours for land holidays, long-haul holidays have regained their former strength (share of turnover: 38 per cent, year-on-year change: +14 per cent), even if the regions are performing differently. Long-haul holidays to Australia, for example, are growing at an above-average rate compared to the previous year, but have by no means returned to their previous level. The Caribbean is currently still lacking holiday sales from German guests, both in comparison to the previous year and to the pre-corona level.

Among the most popular holiday destinations, the Canary Islands remain the undisputed number 1, followed by Egypt in second place with just over half of Canary Islands sales (+50 per cent year-on-year). In the winter travel season - unlike in summer - the holiday region on the western medium-haul route is more important (current share of sales: around 32 per cent) than the eastern holiday region (share: 23 per cent). The Balearic Islands and the Spanish mainland, for example, are enjoying growing popularity here.

The increase in early booking sales for summer holidays in the coming year or even later travel dates is also striking. They have risen from 7 per cent in the previous month to 16 per cent.

Legend:

The chart shows the cumulative travel sales generated up to the end of August 2024 for the current winter season 2023/24 and the upcoming summer season 2024 in comparison to the previous seasons and the pre-corona level (summer 2019, winter 2018/19). TDA's analyses include both holiday bookings in traditional travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package holidays. The chart on the left shows the percentage of sales in the booking month of April accounted for by the individual travel months and seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03