Nuremberg, August 29, 2024 – New bookings in the German tour operator market have remained above the previous year's level since the insolvency of FTI. In the booking month of July 2024, many German holidaymakers also made replacement bookings for their cancelled holidays. Although FTI's withdrawal from the market has clearly cost summer growth on the bottom line, this year's season is heading for a new record: at the current booking level - three months before the end of the season - summer 2024 has almost reached the final result of the previous year's summer in terms of sales (fill level: 97 per cent). This means that this year's summer season is already guaranteed a positive sales balance.

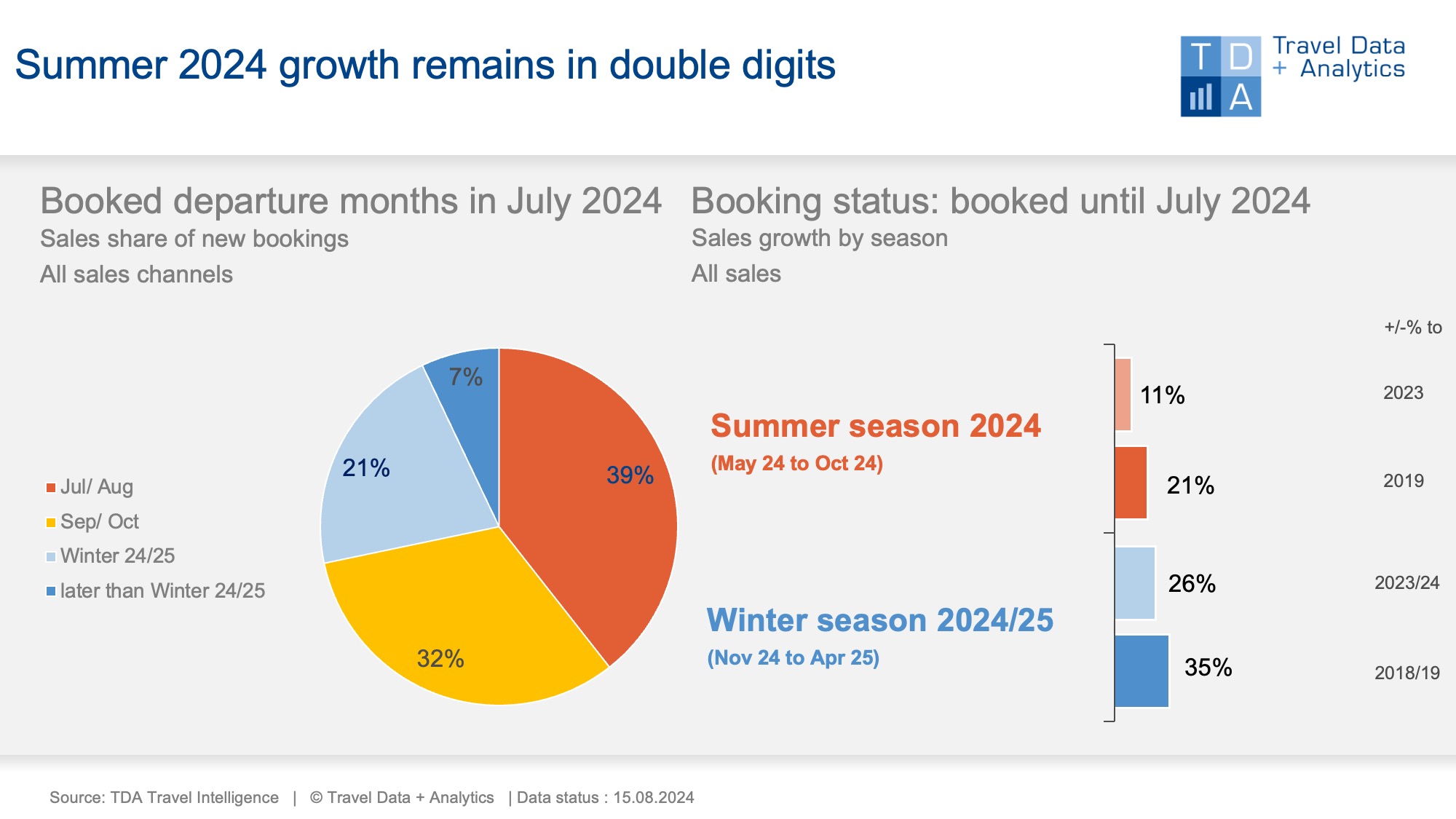

In the past booking month of July 2024, German citizens spent a total of around 1.8 billion euros on holidays booked at travel agencies or online. At 39%, the lion's share of this was accounted for by last-minute bookings with departures in July and August, with a further almost one-third for autumn holidays in September and October. Due to FTI's withdrawal from the market, short-term summer bookings are exactly the same as in the previous year, when an above-average number of late bookings had to compensate for the lack of early bookings. The gap that needs to be closed in this year's summer business is the compensation for the cancelled FTI holidays. Cumulatively, the 2024 summer season still shows a double-digit increase in sales of 11 per cent compared to the previous year at the current booking status at the end of July. Before the FTI insolvency, this figure was 17 per cent at the end of May. The increase in bookings is currently 5 per cent compared to 13 per cent in May. Despite a good level of new bookings, the losses are still far from being offset. And despite all this, the 2024 summer season is already certain to achieve a positive final result in terms of turnover: 97 per cent of the previous year's turnover has already been achieved, meaning that the remaining three booking months from August to October will only determine the final level of growth at the end of the season.

However, the above-average volume of short-term holiday bookings in July 2024 is at the expense of the upcoming 2024/25 winter season, which has lost some of the early booking and high-growth start in the previous month: Cumulative sales growth loses 6 percentage points to an increase of 26 per cent compared to the previous year's season. The number of people booked had exceeded the pre-corona level by 12 per cent in the previous month, but the increase has now shrunk to 1 per cent. If the booking month of July 2019 is taken as the benchmark for ‘recently normal’, early bookings for the upcoming winter season and later travel dates should have accounted for a significantly higher share of sales of around 36 per cent - instead of 28 per cent. However, the market researchers at TDA do not see any reason for concern: ‘The outlier this year is due to the circumstances of FTI's market exit, but holiday demand in the market, as all booking trends indicate, remains fundamentally extremely positive,’ emphasises Alexandra Weigand, Director Sales & Consulting at Travel Data + Analytics.

Legend:

The chart shows the cumulative travel sales generated up to the end of June 2024 for the current winter season 2023/24 and the upcoming summer season 2024 in comparison to the previous seasons and the pre-corona level (summer 2019, winter 2018/19). TDA's analyses include both holiday bookings in traditional travel agencies and online on the travel portals of tour operators and online travel agencies (OTAs) with a focus on package holidays. The chart on the left shows the percentage of sales in the booking month of April accounted for by the individual travel months and seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03