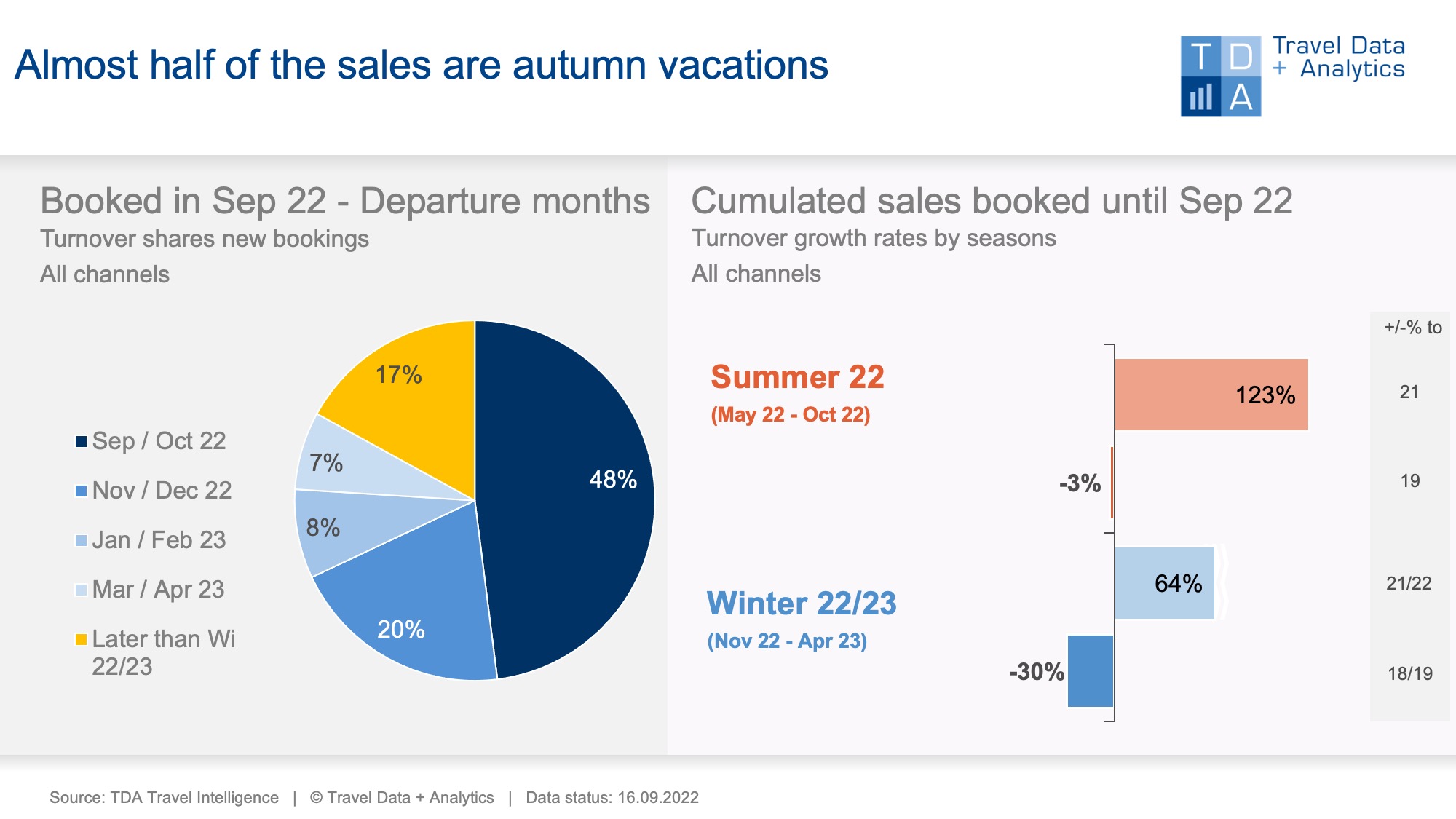

Nuremberg, October 28, 2022 – Holiday travel bookings in September 2022 are characterized by exceptionally strong short-term business for the autumn months: Almost half of the monthly revenue counts on the travel months of September and October – with a revenue increase of 16 percent compared to the same month of September 2019. The summer balance improves by a further two percentage points and is only 3 percent behind the pre-corona level in 2019. Bookings for the upcoming winter season, on the other hand, are behind former levels at this stage of the booking period: Incoming sales in September 2022 are almost one-fifth below winter sales in September 2019.

The summer season 2022 improved again with the strong demand for autumn holidays in the past booking month of September. This is all the more remarkable because in September 2019 a special effect comes into play: At that time, the insolvency of Thomas Cook had caused a particularly strong last-minute volume, as many people had to rebook their planned holiday trips. Cumulatively, this year's summer sales are only 3 percent below the 2019 summer season, which is used as a reference to pre-corona levels. The tour operator trips without cruises even reach a black zero at the current booking status.

In September 2022, almost a third of the monthly turnover is accounted for by the school holidays in October. After August, October is thus the second travel month with a positive sales balance (+4 percent) in this year's summer season. Although demand remains stable overall in the past booking month, a Thomas Cook effect is clearly evident in the last week of September and the first week of October: New booking revenues are no longer keeping pace with the 2019 level.

Although this is significantly more than in the previous month (25 percent), it is only slightly above the short-term bookings received for the autumn holidays in October. With the increases, the cumulative winter balance improves by three percentage points to a minus of currently 30 percent. Nevertheless, monthly sales remain 18 percent below the pre-corona level of 2019. In September, 20 percent of the monthly turnover in travel sales was due to winter holidays with departures in November or December. The following travel months from January to April are only 15 percent. The further the travel time is in the future, the larger the gap. Apparently, many people in Germany are waiting to see how the general situation and their financial situation will develop in the coming weeks in view of inflation, the energy crisis and corona.

Legend:

The chart shows the cumulative travel sales generated up to the end of September 2022 for the 2022 summer season and the coming 2022/23 winter season in comparison to previous years (2019 and 2021 summer and 2018/19 and 2020/21 winter seasons). For the travel seasons, TDA compares the booking status adjusted for trips that were cancelled in previous years due to corona. Both holiday travel bookings in high street travel agencies and online on the travel portals of the tour operators and online travel agencies (OTAs) with a focus on package tours are included. The chart on the left shows the percentage of sales in the booking month March that is attributable to the individual travel months or seasons.

About TDA Travel Intelligence

Travel Data + Analytics (TDA) took over in spring 2019 the travel sales panel run by the Nuremberg market research company GfK since 2004. After the GfK data had been migrated to a new IT landscape, Travel Intelligence was set up as an independent solution with a self-learning database and associated analysis tool. The basis remains the booking data from stationary travel agencies and online portals that sell tour operator products. The requirements of tourism companies on a modern control instrument and evolving, increasingly dynamic questions can thus be mapped reliably and promptly, without giving up the core of a market-representative method that is consistently comparable over time. TDA = Current booking situation + individual product performance + new market opportunities.

Further information: Alexandra Weigand, alexandra.weigand@traveldataanalytics.de, phone: +49 (0)911 951 510 03